FMP

Enter

API Tools

Extras

Gold By Gold SA

ALGLD.PA

EURONEXT

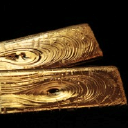

Gold By Gold SA extracts, refines, and trades in precious metals for individuals and professionals in France. The company also purchases and recycles gold and silver on the internet. In addition, it buys and recycles various gold objects, such as jewelry, accessories, parts, yellow dental gold, watches, and debris, as well as silver jewelry and ingots. The company was incorporated in 1997 and is based in Paris, France.

2.24 EUR

0.14 (6.25%)