Top 15 Best & Most Popular Stock Websites in 2026

Sep 30, 2022(Last modified: Jan 05, 2026)

Stock market research is vital for traders to access the entire performance history of a company they plan to invest in or buy stocks from, ensuring future profitability. This research provides a comprehensive library of financial performance data for each listed company, detailing yearly fluctuations since they went public. It highlights strengths, weaknesses, profitability, losses, and other critical forecasts with in-depth details and determinants.

Stock analysis websites offer free and paid features to help traders access stock market research with customizable data insights.

Before the advent of these online resources, investors had to manually gather financial information, which was time-consuming and still left them uncertain about their investment decisions, often leading to lower profitability.

Today, shareholders can confidently plan their investments using advanced stock research websites. These platforms validate data, ensure reliability, create financial fluctuation graphs, and integrate stock APIs for seamless long-term assistance.

This article will guide you through the top stock research websites with outstanding features (both free and paid). It will focus on analyzing, comparing, and recommending the best sites for stock research.

Let's begin your journey into authentic data research!

Best Stock Market Investment Research Sites

Although the number of investor websites available online (free/paid) has reached its summit and today, there's a saturation that could be seen among these websites. Due to rising competition and advancement in features and subscription fees differences, we have listed some top-of-the-list stock research sites for you. Through surveying them and taking a side-by-side evaluation look over their features, it'll be easy for you to select the best matching website, coping with the particular requirements you're searching for.

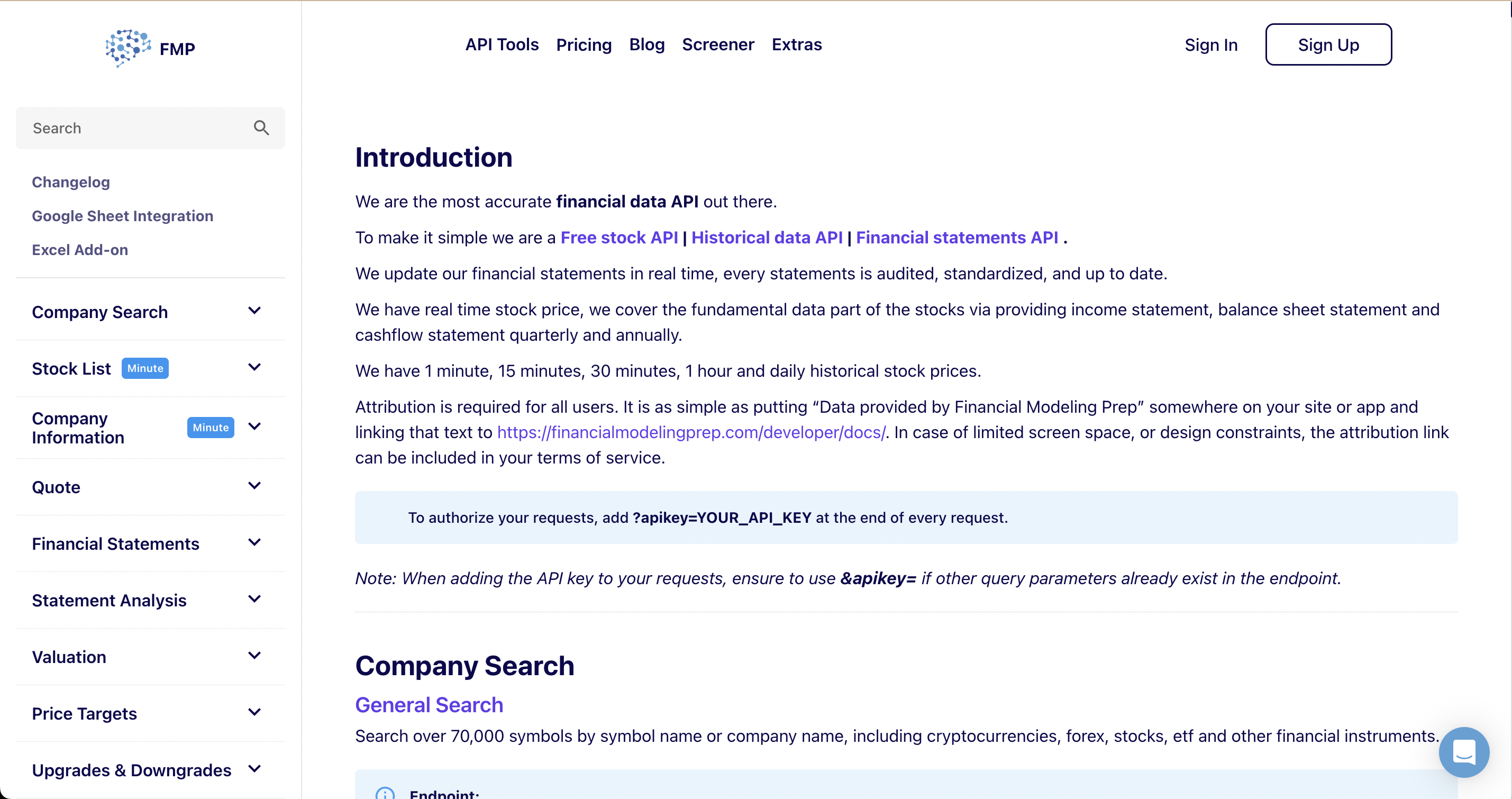

1. FinancialModelingPrep

FinancialModelingPrep or FMP has overall an emerging interface of providing investors with focused information in finance. Among all 14 categories discussed under the title of best stock market research websites, FMP has more advanced features with a 24/7 free subscription plan. That's why investors can prevail on maximum data with zero fees in 5 minutes, right after reaching the FMP stock block for researching stock market trends.

By skipping to the principal services FMP provides to its users, there's a sectional distribution of assistance designed for every level investor to get started with.

FMP is a station for authentic financial API integration and has attracted developers and investors to achieve their financial goals professionally. The API possesses a sidebar of uncountable features that investors can use as tools for interpreting the fluctuation rate in the company's fiscal years performance.

Features:

Systematic Stock Research

The information provided of stocks is detailed with symbols and income score addition. This research has real-time and historical, both periodic records through one-click effort. The inflation in stock prices could also be measured by extracting data on personalized Google sheets or Microsoft excel to create an individual-level plan.

Multilingual API Support

The API supports JSON, JavaScript, Python, PHP, and more languages selection, standing as a REST API. Applications joint at margins with FMP tools have Python API capabilities to restore HTTPS protocol for submitting authentic requests to datasets. However, JSON API still works better in many phases.

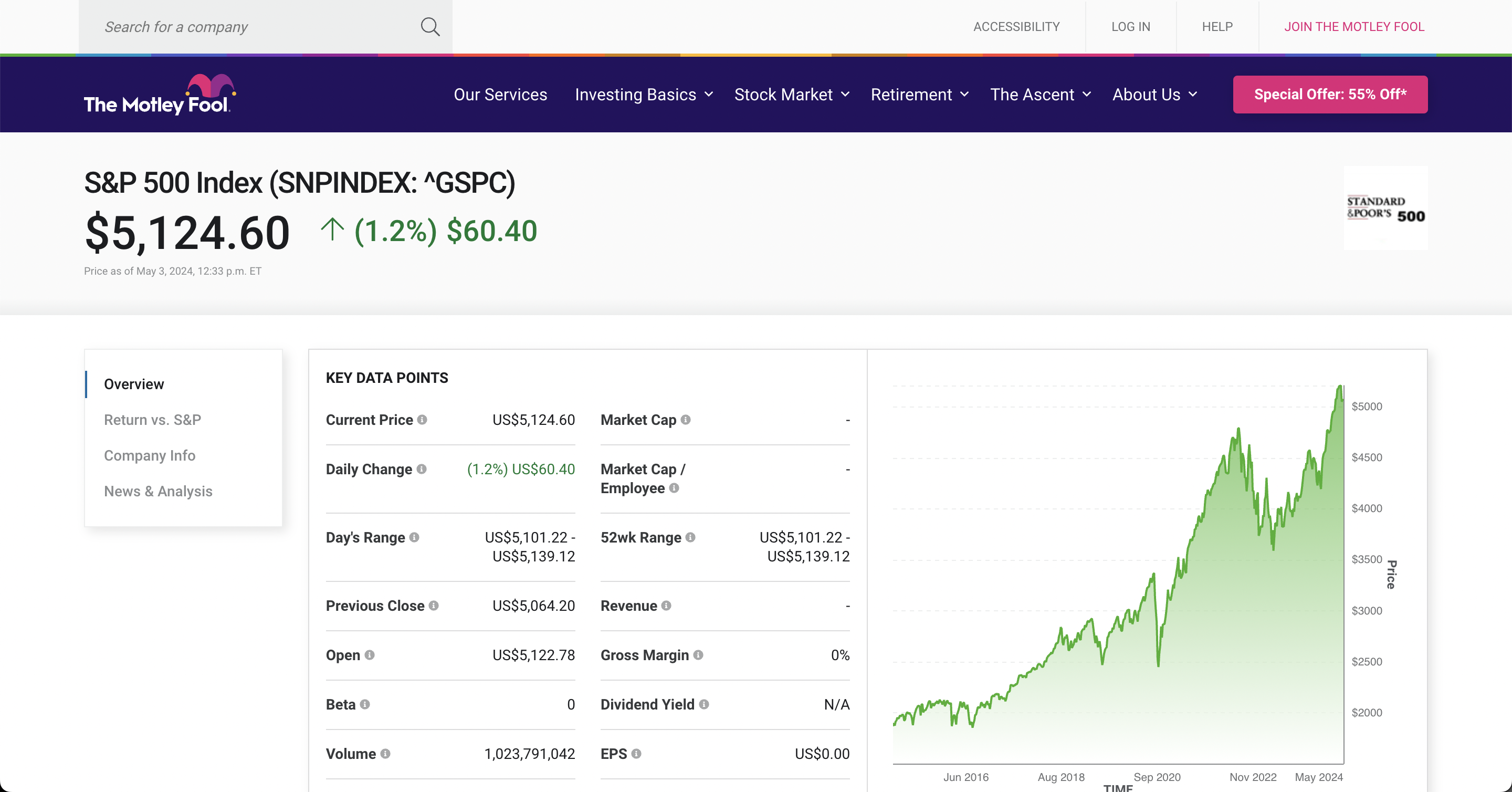

2. The Motley Fool

Motley Fool is a dependable financial and investing advice entity, available with an extensive chart of features it offers to its users. The name "Motley Fool" has been derived from William Shakespeare's comedy play - As You Like It and denotes an individual personality, habitual of revealing the truth, without coming under the force of any external power.

Overall the website supports financial portfolio management, picking services of stocks, and better recommendations for investors (both beginners and experienced) to stay with their stocks. But the main two sections submitting Motley Fool's trademark to another greater height are its two paid services, including Fool Stock Advisor and Rule Breaker.

Features:

Stock picks per month

The flagship service Fool Stock Advisor generated an estimated return ratio of 991% with S&P 500 of 197% (since the inception of its service in 2002). Those stepping as novices in the stock industry required to develop a financial portfolio have maximum assistance with five stock pick-up recommendations monthly. It makes an open platform with stock alert newsletters to invite investors towards less risky stocks and has been recorded on the Wall Street Journal orthodoxy page.

Stock Portfolio Expansion

On the other hand, Rule Breakers' services come along with Stock Advisor and have been promoted to expand stock picks and investment portfolio volume. This is typically less costly than Stock Advisor and underlines everlasting growth stocks portfolio.

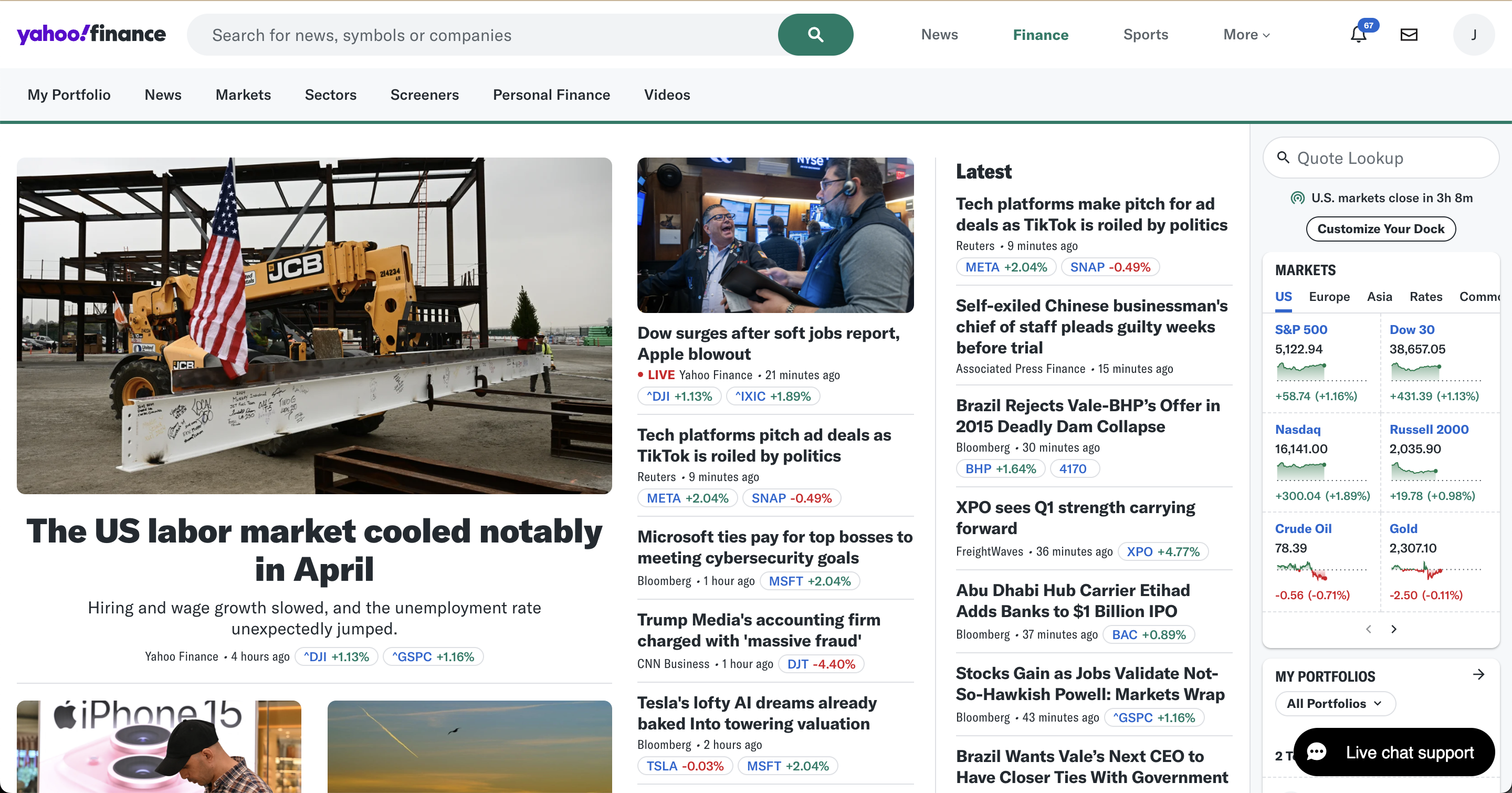

3. Yahoo! Finance

Yahoo Finance is seen to be ranked at number 19th world's famous financial news and entertainment proclaiming website - stated by SimilarWeb. Its emergence has great significance in the financial world. Investors rely on multiple features, promising accurate information delivery of stock quotes, financial reports, and updated press releases, possessing original data.

Including a vast services ground that Yahoo Finance supports, it provides stock API integration on paid sign-up.

Many of Yahoo Finance's features are free including, accessing listed companies' stock changes, news/media interpretation for financial plans, and more. But the free/trial period has a complete stop, and that's why there are many alternatives to yahoo finance API available today.

However, users will unlock additional features after completing the free trial period by subscribing to its paid version.

Until now, you don't need to be worried at all. Some paid and advanced stock market research services offered by Yahoo Finance are as under:

Features:

Extensive Collection of Portfolio

After subscribing to the paid version of this website, investors are allowed to sweep in the company's portfolio holdings. This can help to assemble the assumptions regarding companies to see if they're eligible to invest in or not. The holdings information provided conquers data configuration from bonds to stocks. Hence, shareholders can predict their profit graph.

Stock Worth Summary

A comprehensive summary of stocks' worth could be developed with access to present and historical stock prices. The value of stock displayed for users has an automated arrangement ability to get aligned in a row to interpret whether the previous performance rate competes with present performance abilities or not.

Third-party Monitoring

The information obtained from third-party APIs is also available to monitor how professionally the data is being managed. This monitoring also suggests the quality propagation of users with stock websites, confirming that there's no involvement of self-stated information.

Daily Trade Charts

Charts made on fluctuations recorded in stock value rise and fall are of great importance. But for investors accessing these charts daily is a bit uncommon. However, there's a possibility created by yahoo finance to get charts on daily roundups. These trade charts contain each element of stock changes every day and influence invested property.

4. MetaStock

MetaStock is not similar to other discussed websites, helping to resolve financial convulsions, available for financial data analysis. It's instead a Computer Program designed for executing critical analysis of stocks or financial datasets. Services availed by this site are all paid and have comparatively higher subscriptions fees than other non-technical stock websites.

MetaStock is officially launched with XENITH Real-Time data and end-of-day trading/stock exchange news and x-ray information of everyday changing stocks. Its background is connected with multiple products/software specifically designed to provide statistics and analysis of financial data.

The data displayed from the assemblage of these software have different forms of charts. These charts are systematic and highly qualitative to calculate stock from other stock markets of the same company. In this way, investors get the summit of knowledge in the financial ground to find the best regions for making their investment reliable and even more profitable.

Features:

Professional Level Analysis Tools

Not only a handful of tools, but MetaStock is up-moving with hundreds of analysis tools (each gives an unprecedented chart of stock analysis), helping shareholders understand stock information clearly. These tools are identifiable through their facility in measuring stock data from different angles. Investors new to the stock market could cope with the least stuffed software/tools.

Real-Time/End-of-day stock updates

The integration of XENITH technology and abilities to negotiate pervasive data of more than one company has made MetaStock the world's largest private trader platform. The collected information has segmentation into three sections: Day-time, intra-day, and end-of-day. These models of showing data by existing in stock markets for the whole week are advancing MetaStock infrastructure among traders worldwide.

Institutional Level Data Mining

MetaStock provides tools contrasting previous financial rank with the present to help out institutions listing and compiling their annual to quarter financial score. Many other tools are available alongside to prompt institutional-level data mining and analysis of information gathered.

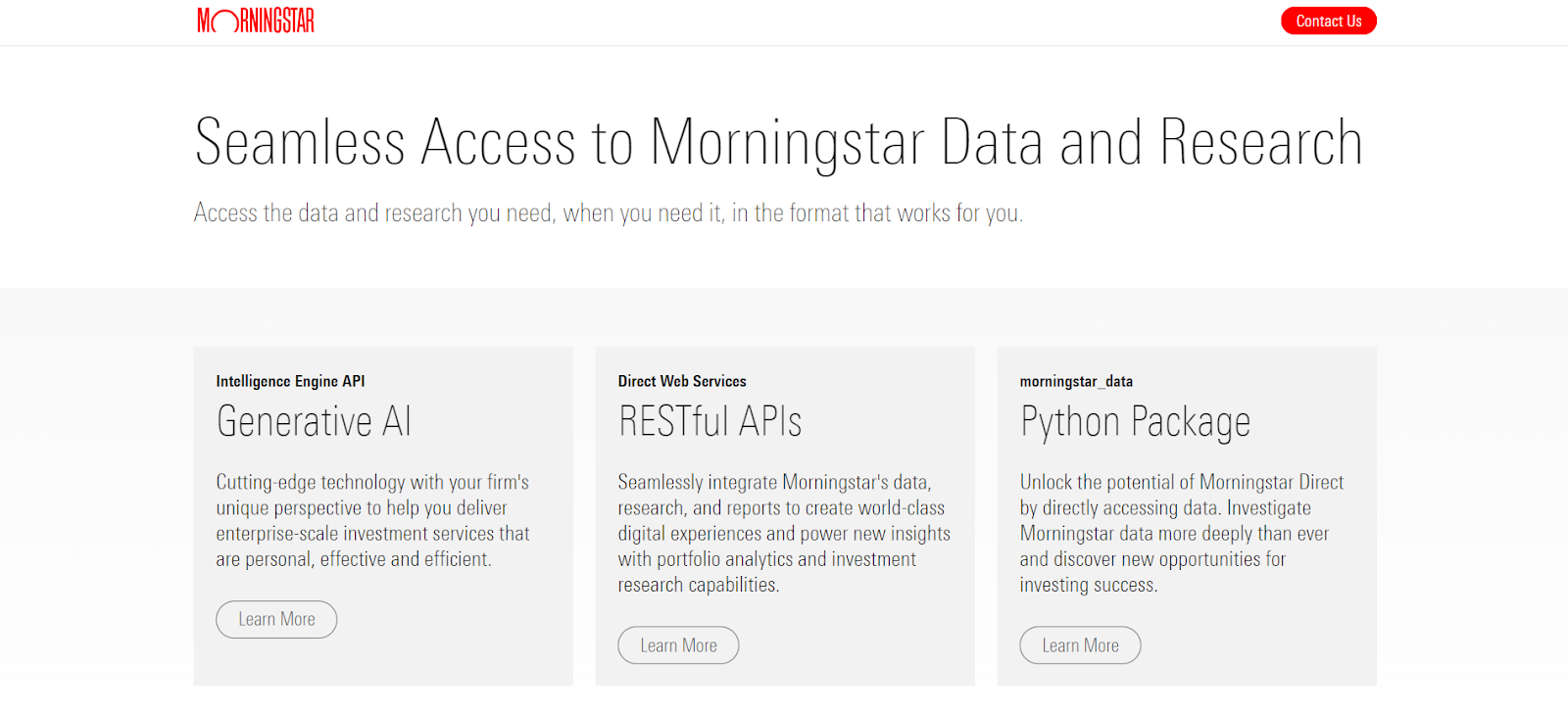

5. Morningstar

Morningstar is a Chicago based world's most recognized financial advisory firm. Every investor searching for financial analysis terms interacts with morningstar due to its bilateral service opportunities for both its paid and free subscribers. In a basic overview, the company is super-active in mining authentic stock picks, the suitcase of investment procedures, and daily updates through news feed and newsletter.

Most of the features required to generate an investment plan are available on Morningstar with a freemium subscription. But this period has limited access. After that, premium sign-up comes up to provide magnifying results against each research.

The exceptional feature that we can circle as prominent and supported by Morningstar is its fund's pillar rating. This provides investors comprehensive columns of determining funds with ranking status and fund category.

The interface of Morningstar is highly understandable, with no challenging context created to get started with stock market research. Many tools and API features are also available for traders to keep a straight record of stocks, ETFs, and more than 2,000 funds necessary in multiple investment plan determination. In contrast, Motley Fool provides only funds in detail in a section of premium subscription.

Features:

Entrance in Global Stock Community

Morningstar is a vast financial advice network comprising the US exchange portals in hundreds and expanded over Asia, Australia, Europe, and other inter-linked stock information spots. It's thus considered a global stock community.

Hybrid Securities Research

After narrowing the research tactics against general financial reports and stock rates, Morningstar has the nature of hybrid securities research. Including stocks, the website has advanced locations to access mutual funds, equities, assets, ETFs, and other financial information.

API Integration Options

Apart from being exposed to a go-to attitude in the interface, Morningstar is flexible enough to provide investors with a lifetime service by going to users' applications themselves. It is possible with the premium subscription of Morningstar API that counts an extended tab of features essential for quickly approaching the financial score of companies.

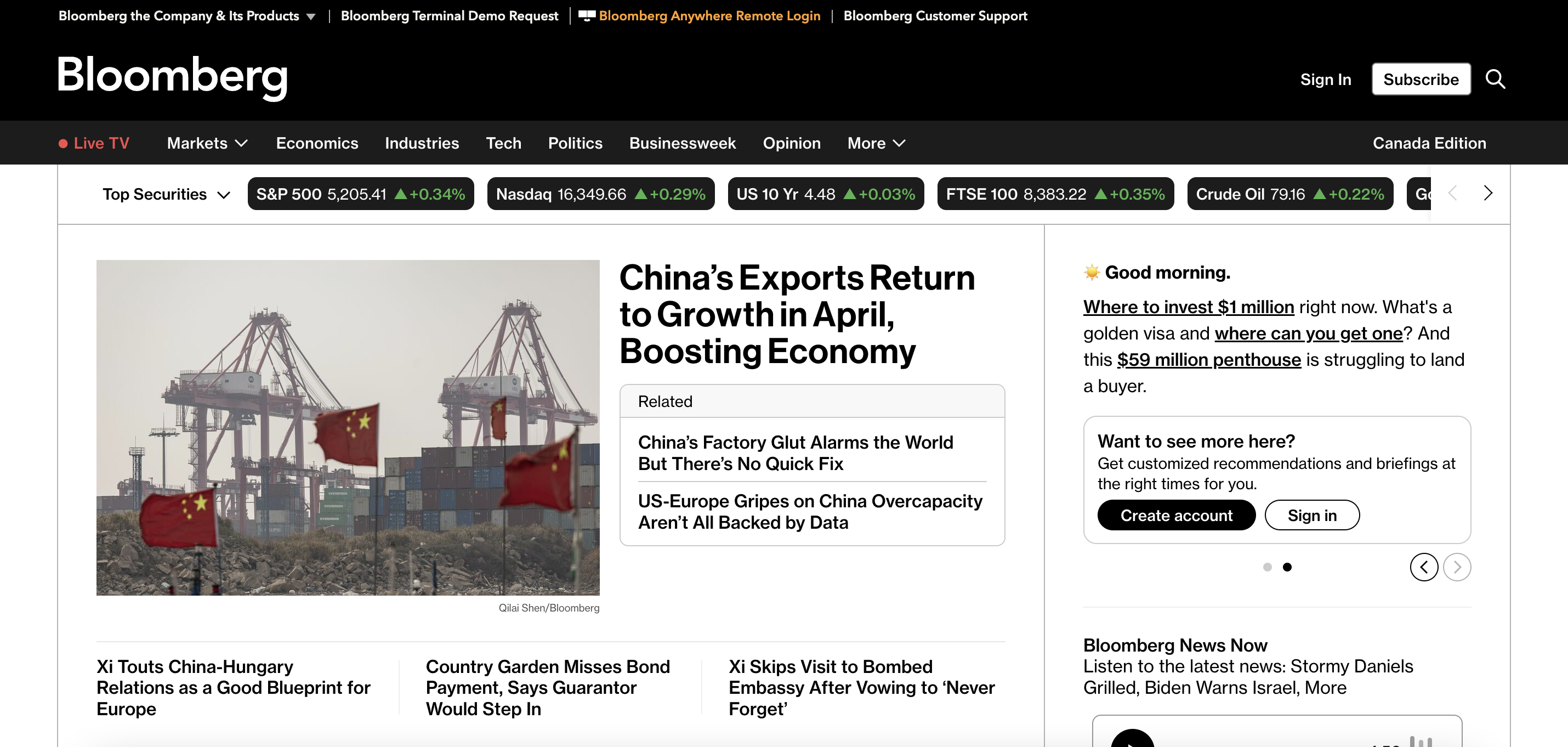

6. Bloomberg.com

Bloomberg is a privately held financial and entertainment news reporting firm, found throughout the globe at different locations, with headquarters in New York City. Principally the company operates to provide investment information and tools/software to yield comprehensive and required trading data on an individual to an institutional level.

The portal of tools designed to make investment reliable and efficient has different contexts under the financial domain. These tools are specialized in multiple sections including, Electronic Trading, Family Offices, Hedge Funds, Portfolio Management, Private Equity, Research and Analysis, Sales, and Trading. These specifications of tools denote the importance of each factor's characteristics and contributions in making a financial plan to the mark.

Bloomberg is entirely a propulsion entity, getting investor's bunches and business in-sighters closer to their point. It takes two magazines (Businessweek & Markets), radio, news, and direct stock market research portals to help investors find their proper scope.

7. The Wall Street Journal

So, after searching across different technical and partially technical websites supporting stock market research, the Wall Street Journal is the next stop to find analysis procedures in another way.

The Wall Street is a US-based English journal, also available in Chinese and Japanese, and recorded as one of the top-ranked business journals in the world. The subject of reading online has added to this Journal's worth, which is presently supporting each domain under the business world, where stock market news also covers a big plot.

This Journal provides the latest to oldest details in the ups and downs recorded in the global stock exchange world in the market section. This information holds nothing but stock change reasons and updated news from Asian, American, and Australian massive investment institutions.

Since the Journal publishes six days a week, each update or change made from financial communities across global stock markets is available. In this way, it's the best calculator for establishing weekly graphs of stock rates.

Features:

Detailed Reasoning of Data Fluctuations

Journals have the nature of providing an in-depth curriculum regarding events that took place in times. Similarly, every stock or listed company's shares value modification will be delivered through the investigators of Wall Journal.

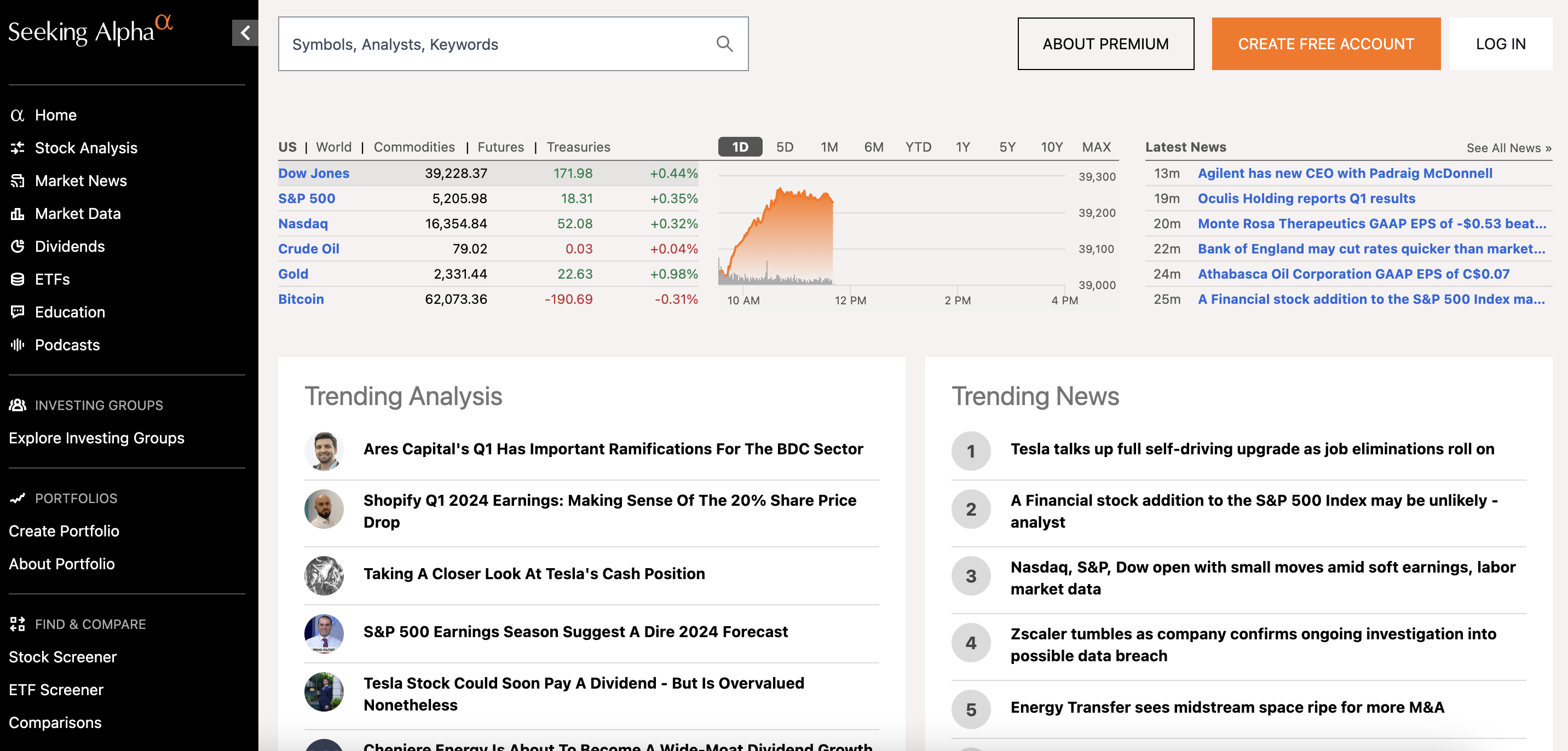

8. Seeking Alpha

It would not be wrong to say that Seeking Alpha has ingenious adaptations in contrast to other investor websites available today. The interface we get by simply reverting to the homepage of the website is highly interactive and problem-solving. In a sequence of offered services, Seeking Alpha has a professional categorial arrangement in each service bar. Users are independent to seek directions in individual investment plans as well as for institutional growth possibilities.

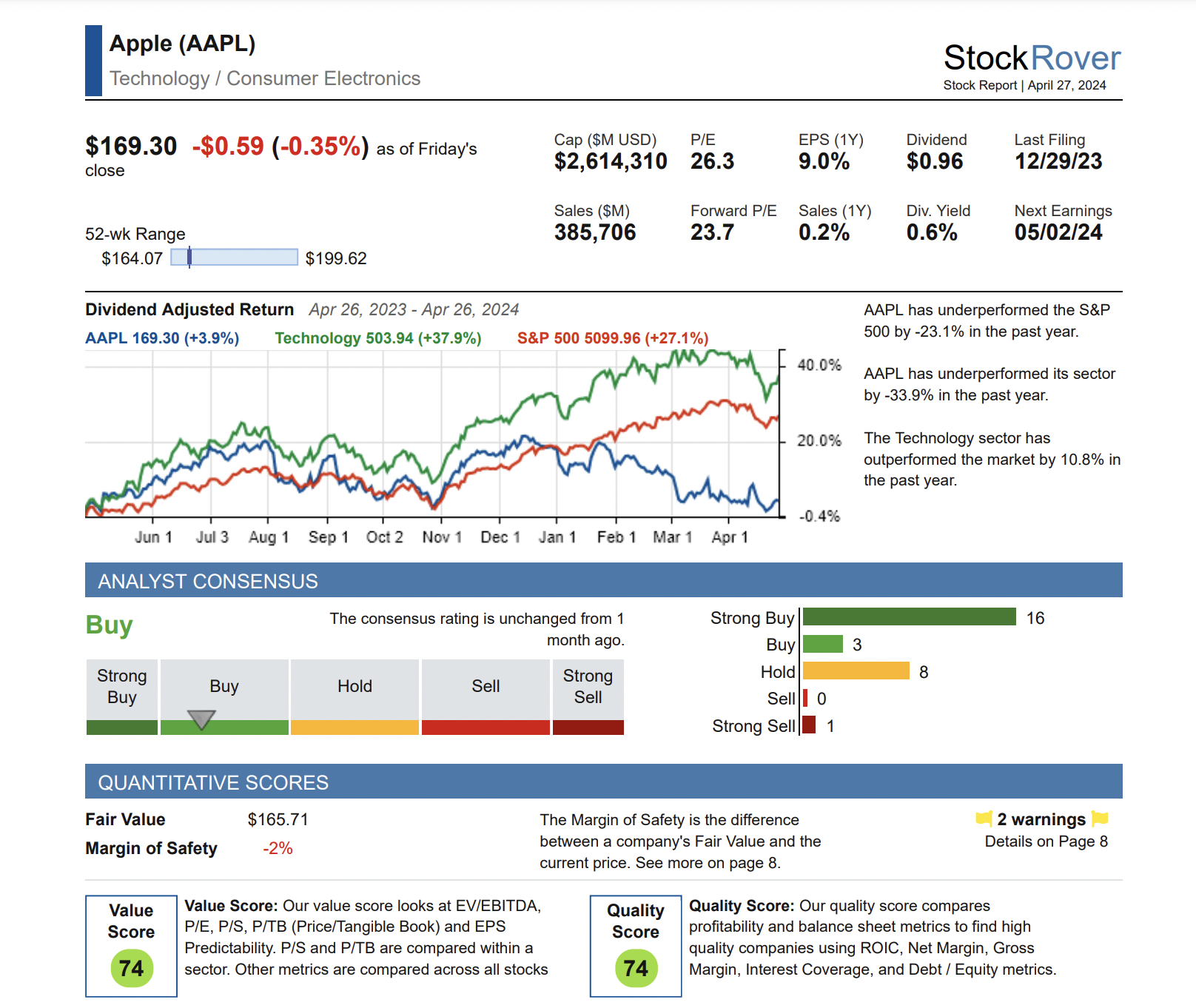

9. Stock Rover

Stock Rover is a web application that produces expert-stage stock analysis skills for personal and professional-level traders. It offers exceptionally around 700 in-work, stock-related, and price-conduct ratios and in-depth stock information for over 40,000 stocks, funds, and ETFs.

Stock Rover facilitates you to monitor your investment portfolio with explained operational in-sight, emailed execution statements, deep portfolio research devices, exchange devices, investment devising, and re-balancing fluency.

You can further build real-time analysis sheets that give a complete essential and technical prospect of the organization's market movement for one decade in a row. However, more advanced plans come under premium subscription. This help operates as a web-based small application and provides many cooperative services and possibilities based on your analysis and interpretation terms.

Features:

Comprehensive Stock Buying Route

Stock Rover offers an understandable updating convenience, a real-time stock screener. For example, using which organizations operate under their expected objective value and denoting events to purchase stocks with an integrated border of protection.

Brokerage Connect

One of the remarkable characteristics of the web-based application is Stock Rover's "Brokerage Connect." It offers users read-only information about their investment portfolio assets.

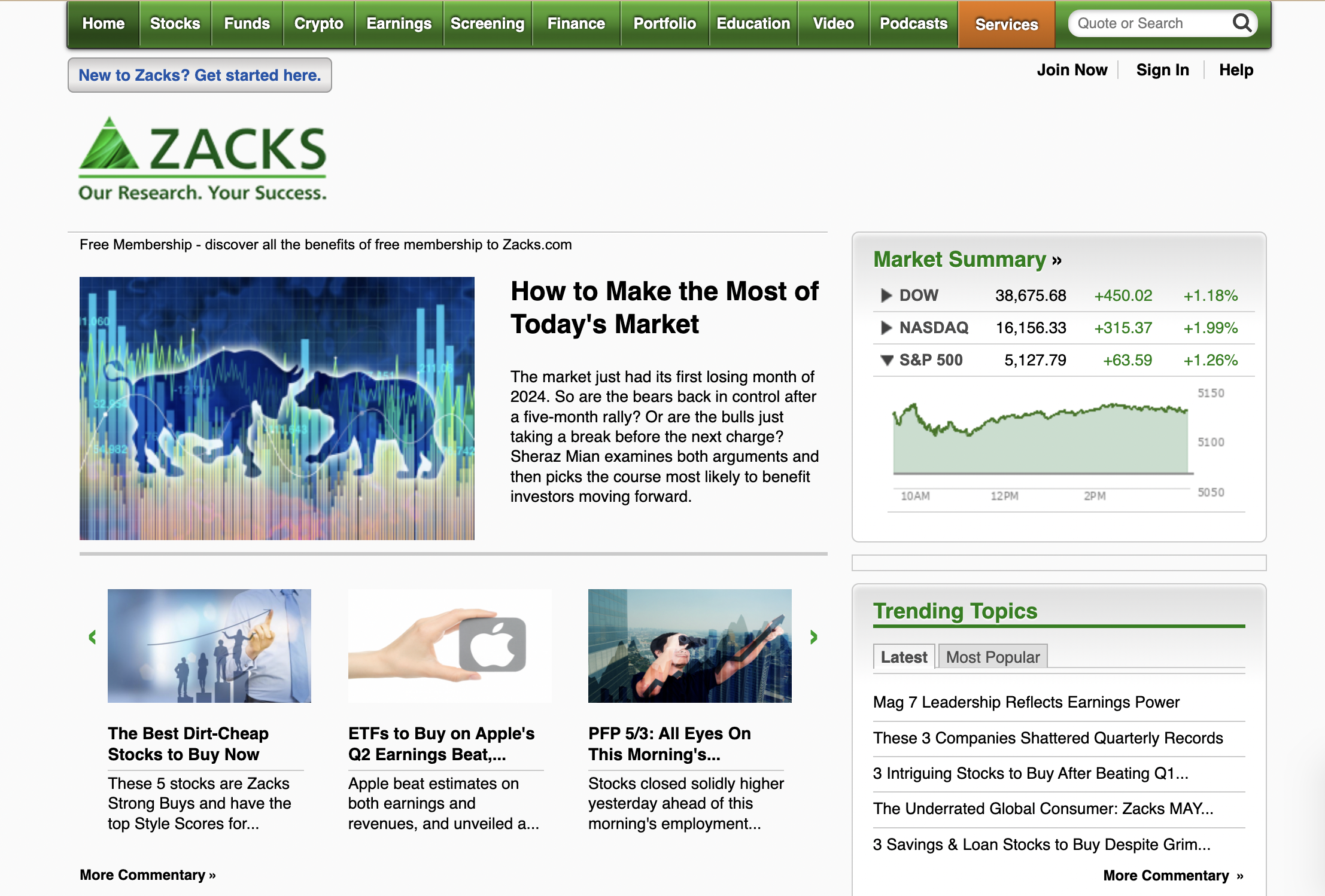

10. Zacks Investment Research

Zacks Investment Research provides a detailed compilation of data for over 5,000 organizations operating on public markets. This information involves stock investigator measures for interest and profits, agreement ratings, and more. It comes with multiple rating options under a paid subscription. The yearly subscription fee is $249 (entry price).

The data comes from stock research that has income status rank distribution. Likewise, you can employ the service as your funds exchanging broker with the best priced exchanging affiliation and border loan values.

11. Investing.com

Investing.com is widely used by retail investors for market quotes, charts, news coverage, and broad asset-class tracking. It provides stock exchange exact quotes, explicit acknowledgment of stocks, predictions, selection, research, products, and an economic calendar. This website has a diversity of services and features to navigate constantly modifying financial data. Principally, the significant features come through a free subscription. However, paid plan expands personalized investment analysis up to institutional stock research.

Features:

Real-Time Alerts

Adding stocks information, investing.com has a professional interface for crypto, forex, funds, ETFs, and other fundamental data research. All the data gathered shows real-time form and hence made the background difference, providing investors the periodic improvement aspect of companies.

Advanced Portfolio Features

It adds a portfolio with double scalability margins and raises the volume of an investment asset. The advance portfolio encompasses the management of components declaring whether the portfolio is eligible for investment or not.

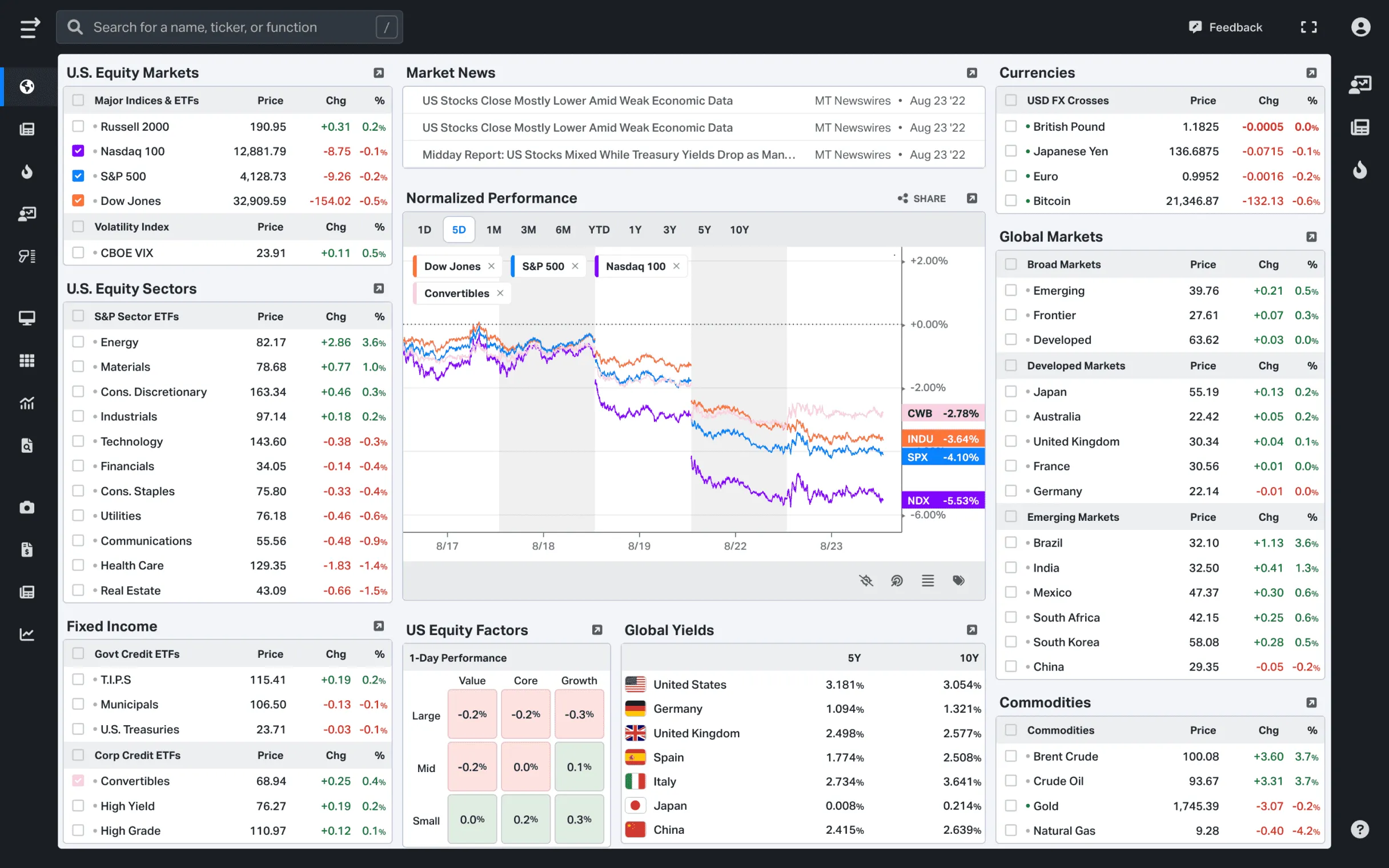

12. Koyfin

Koyfin is the kind of platform you end up using when you are tired of stitching research together from ten different places. You pull up a company, and you can immediately see the basics that matter. Price performance, valuation multiples, financial statement trends, and key ratios, all in one view. It also makes peer comparison easy, so you can quickly answer questions like “Is this company actually cheap, or is the whole sector trading at similar levels?”

Where Koyfin really helps is day-to-day workflow. You can build watchlists, group companies by theme or sector, and track how a basket is moving over time. If you are doing regular screening and you need a clean way to validate ideas before you go deeper, it saves a lot of time. It is not trying to be a trading platform. It is more like a lightweight research terminal that keeps your analysis organized and consistent.

Best for:

- Research dashboards

- Peer comparisons

- Watchlists

- Macro context

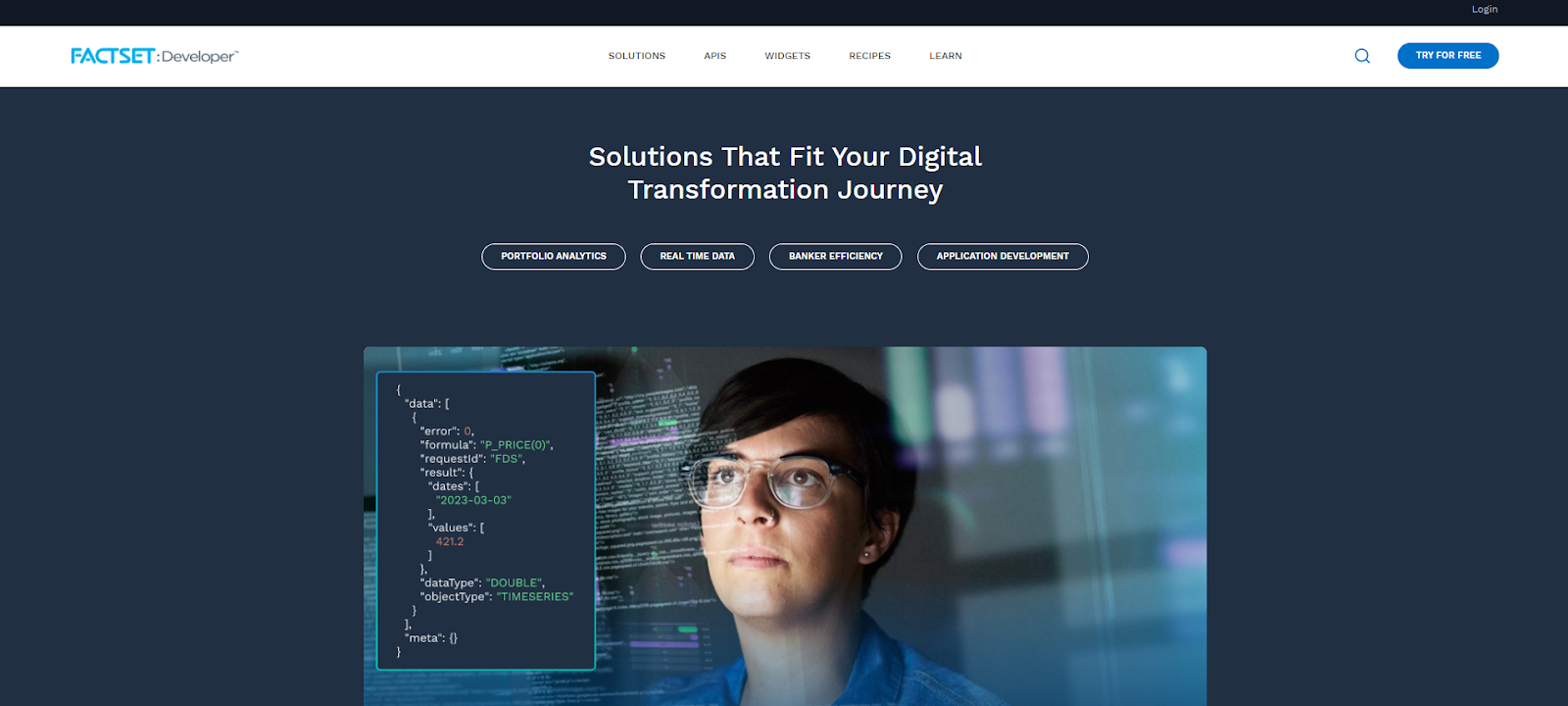

13. Factset API

FactSet is also a very popular listed company famously known for its data and analytics solutions. Like Morningstar, FactSet is also trying to compete in the financial API market through its fairly new API platform.

FactSet's API library is awe-inspiring and filled with a lot of unconventional endpoints. Their APIs range from the fundamental ones to Analytics and AI/ML endpoints.

Apart from their API library, FactSet lags in a lot of different things. They don't have a central/consolidated documentation page, rather, we have to navigate to the individual API endpoint page to get to know more about it. Also, the arrangement of the APIs is confusing and one might have a very hard time finding the API endpoint they are looking for.

Similar to Morningstar, FactSet doesn't reveal their pricing explicitly on their website and we have to get in touch with the sales team to get a quote. This is because FactSet as well as Morningstar primarily focus on companies to be their customers, and in most cases, companies have tailored requests and they tend to deviate from the normal subscription plans.

To conclude, FactSet is definitely not the place for individuals but can be a treasure trove for companies who are looking for numerous types of data for various use cases.

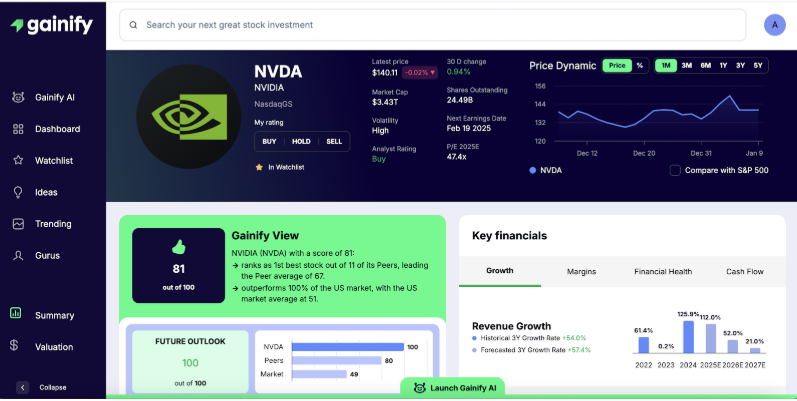

14. Gainify

Gainify transforms complex stock data into actionable insights through pre-built strategy screeners, trending stock identification, expert-verified and proprietary valuation metrics, and breakthrough AI connected to real-time Wall Street data. Users can also track the portfolios of top investors and members of Congress, providing real-time alerts to help you replicate successful strategies. Gainify stands out by making it easy to spot tomorrow's winning stocks, today.

Feature 1: Comprehensive Research Capabilities

Pre-built screeners and trend identification combine market sentiment, expert movements, and proven investment strategies to uncover stocks poised to outperform. Guru tracking helps you track top investor portfolios from Wall Street to Washington, with instant alerts on significant trades. Together, this helps you spot opportunities before they become mainstream and replicate top investors' success. You can even compare top investors head to head or save their portfolio to your watchlist.

Feature 2: AI Analysis

Unlike generic chatbots trained on old data, Gainify's breakthrough finance-specific AI analyzes real-time Wall Street data to deliver expert insights. You can ask specific questions like "What are the key risks facing Apple in 2026?" or "How does Tesla's valuation compare to other EV manufacturers?" and get actionable insights you can trust in seconds. Gainify's AI also decodes earnings calls and uncovers hidden market signals for you, providing strategic intelligence for confident investing.

Feature 3: Stock Valuation and Market Insights

Gainify provides more than just basic stock data-giving investors essential signals needed for strategic investment decisions. Know when to buy, hold, or sell - with confidence. Access breakthrough capabilities through proprietary metrics and deep trend analysis. Gainify's expert-verified valuation system combines historical trends, forward-looking growth indicators, and institutional-grade data on 25,000+ global stocks to systematically discover top opportunities.

15. TradingView

TradingView is one of the most widely used charting platforms for traders and investors. It's built around clean, fast technical charts, but what makes it stand out is how easy it is to explore ideas. You can pull up almost any ticker, add indicators in seconds, compare multiple assets on one screen, and save layouts for different strategies.

It also has a strong community layer. Traders publish charts, setups, and notes publicly, so you can see how others are thinking about the same stock or market. If you want to go deeper, TradingView's Pine Script lets you build custom indicators and simple strategy logic directly on the charts, which is useful for testing ideas before you move to full backtesting in Python.

Best for:

- Charting

- Technical analysis

- Alerts

- Idea discovery

Which Online Stock Broker is Best For Beginners?

Interactive Brokers (IBKR) can work well for beginners if you are picking a broker with a longer runway. It is known for low fees, strong execution, and access to a wide range of markets, which makes it a practical choice once you start expanding beyond basic U.S. stock buying.

The only real downside is that the platform can feel a bit “too much” on day one. The good part is you do not have to use everything. You can start with the simpler Client Portal, stick to straightforward trades, and lean on IBKR's Traders' Academy and built-in research tools as you learn.

How Do I Find the Best Stocks?

In the above-discussed fiance websites, many are offering stock pick services. This service will help you collect options regarding the best-contrasted stock near you. After submitting the investment portfolio information to the system, the automated process will land you on profitable stocks if you plan to invest in them.

Best Stock Market Websites to Invest

Among the list of best stock market websites, those offering premium subscriptions are highly specified, and not every beginner investor can benefit from investing in all of them. Choosing a website after determining your financial goals can save you better in your investment journey.

FinancialModelingPrep is decent advice for beginners, intermediates, and experts to get started with as it doesn't involve complex data charts and financial arguments.

WallStreetZen makes it easy for part-time investors to perform heavy fundamental analysis and get new stock ideas in minutes, not hours. This stock analysis software aggregates the latest financial data and summarizes a stock's fundamental strengths and weaknesses in simple, one-line explanations that help you make better long-term investing decisions.

Stock Screener

WallStreetZen isn't the only site with this type of feature, but what makes it one of the best stock screeners is the extremely intuitive interface that helps you find new stocks in minutes, based on whatever quantitative and qualitative criteria you find most important.

If you're not sure what criteria to use, WallStreetZen's stock screener also comes with a library of pre-filtered stock ideas to get you started.

ScreeningTale

ScreeningTale.com is the best free backtesting tool out there. The website lets you create detailed stock screeners by combining over 100 filters ranging from financial data and analyst grades to technical patterns and put/call ratio. The screeners can be backtested on more than 20 000 stocks from the top 30 exchanges around the world.

Features:

Backtesting

The main feature of ScreeningTale is testing how your strategy would perform if employed in the last decade. The backtesting feature is perfect for doing a reality check before using a new strategy, or for testing various ideas to see how to outperform the market. The backtests include fees in its calculations, and the underlying data is free for survivorship bias in the US.

Screening

When you have created a screener, you can see all stocks that match your criteria live. You can also save your screener, so you can come back daily to check which stocks have entered the screener and may be candidates for your portfolio.

Historical Stock Data

All 20 000 stocks have their own overview page where you can see all current and historical data. What makes ScreeningTale's overview page unique is the ability to plot all available historical data. This means that you can check how a companys' P/E ratio, ROIC and EBITDA margin has changed over the last ten years.

Conclusion

Investment can profit in millions if your inquiry about the stock market is accurate. What does a precise inquiry demand from investors? It's the authentic usability of stock market research websites, involving their features and comprehension of stock fundamental data to make an effective financial plan.

Currently, there are thousands of stock market research websites available on the internet with both freemium and premium subscription packages. But the majority of this site's crowd doesn't support specifications in guiding beginners to start pushing their investment plans up. Consequently, inappropriate decisions could lead to investment loss or downward movement of the profitability graph.

Therefore, selecting the best investor website plays a vital role in making investment plans 100% working on concrete standards. The discussed websites are selected by exploring their worth percentage in the realistic prospect of using finance analyzing tools.

Frequently Asked Questions:

Why is Stock Research so Important?

During investing, identifying above an average number of stock market components, you handle the opposite direction of the business to produce better funding outcomes. The aim of practicing stock market research is to obtain the understanding you use while devising investment plans.

Without analyzing the stock market, the example of an investor is like a blind. By knowing nothing about the company's financial movement, losses, and incomes, over the last contrasted years, if investors invest in stocks, there's no guarantee that they'll earn satisfied profit as a consequence or not.

What is Stock Market Investment Research?

The investment research indicates collecting all important components possessed by companies that show profitability or decline in profit ratios. Based on collected information, the investor can predict whether the company will earn profit for him or not.

Stock market research is another name involving personal level skills to rejoin to measure the fluctuations taking place in a company's financial position over the years. However, there are tools and websites available to help investors find the best propagating company for investment in the market.

What Do You Want To Do With Your Money?

The better way for using money more productively comes through investment options. Instead, you purchase a vehicle as an investment, focus on other routes where investment can be more productive and profitable.

Stocks, funds, and cryptocurrency are popular these days for investing money to earn better in the future. Because of these reasons, some organizations or MNCs have ever-green product lists that never fail to impress customers, and consumers from all around the world are converted to buy these essential services/products to facilitate their life. Investment in such stocks/shares is life-saving.

How Do You Buy Stocks Online?

Buying stocks online is not an arduous task nowadays. There are brokers available online that make traders burden-less by providing them complete access to procedures through which reaching and investing in stocks is not laborious. Brokers could come as free or paid websites. They offer stock histories and comprehensive processes of selling stocks.

Those who find brokers out of their game can use Direct Stock Purchase Plans (DSPPs). These plans allow multiple modes to buy stocks directly from companies.

Top 5 Defense Stocks to Watch during a Geopolitical Tension

In times of rising geopolitical tension or outright conflict, defense stocks often outperform the broader market as gove...

Circle-Coinbase Partnership in Focus as USDC Drives Revenue Surge

As Circle Internet (NYSE:CRCL) gains attention following its recent public listing, investors are increasingly scrutiniz...

LVMH Moët Hennessy Louis Vuitton (OTC:LVMUY) Financial Performance Analysis

LVMH Moët Hennessy Louis Vuitton (OTC:LVMUY) is a global leader in luxury goods, offering high-quality products across f...