CAPM: Capital Asset Pricing Model - A Comprehensive Guide

Nov 10, 2023(Last modified: Apr 18, 2024)

CAPM: Capital Asset Pricing Model

The Capital Asset Pricing Model (CAPM) is a financial model that describes the relationship between the expected return and risk of an investment. It is one of the most widely used models in finance and is often used by investors and financial analysts to make investment decisions.

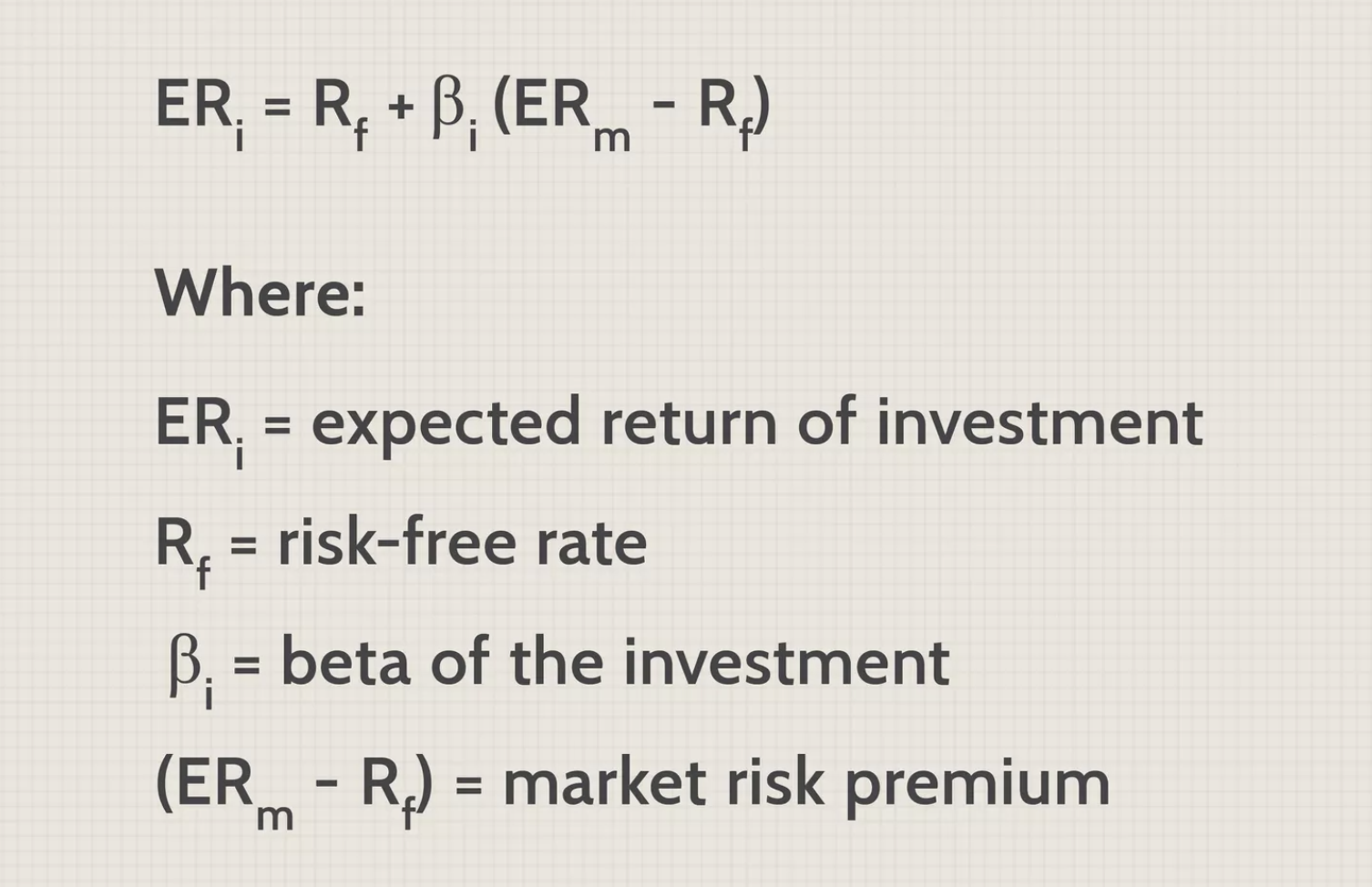

CAPM Formula

The CAPM formula is as follows:

Expected Return = Risk-Free Rate + Beta * (Market Return - Risk-Free Rate)

Image:

Key Components of the CAPM Formula

- Risk-Free Rate: The risk-free rate is the return that an investor can expect to earn on an investment with no risk. This is typically considered to be the yield on a US Treasury bill.

- Beta: Beta is a measure of the volatility of a security or portfolio relative to the market. A beta of 1 indicates that the security or portfolio is expected to move in line with the market, while a beta of greater than 1 indicates that the security or portfolio is expected to be more volatile than the market.

- Market Return: The market return is the return that an investor can expect to earn on a broad market index, such as the S&P 500.

How to Use the CAPM Formula

The CAPM formula can be used to calculate the expected return of an asset, given its risk-free rate, beta, and market return. For example, if an investor is considering investing in a stock with a beta of 1.2 and the market return is expected to be 10%, the CAPM formula would predict that the stock's expected return is 12%.

Limitations of the CAPM

The CAPM is a powerful tool for estimating the expected return of an asset, but it is important to note that it is a simplified model and has a number of limitations. For example, the CAPM assumes that investors are rational and have access to perfect information. Additionally, the CAPM does not account for all of the factors that can affect the return of an asset, such as macroeconomic conditions and company-specific risks.

Despite its limitations, the CAPM remains one of the most widely used models in finance. It is a useful tool for investors and financial analysts to understand the relationship between risk and return and to make informed investment decisions.

Conclusion

The Capital Asset Pricing Model (CAPM) is a financial model that describes the relationship between the expected return and risk of an investment. It is a widely used model in finance and can be used to calculate the expected return of an asset, given its risk-free rate, beta, and market return. While the CAPM has some limitations, it remains a valuable tool for investors and financial analysts to make informed investment decisions.

Top 5 Defense Stocks to Watch during a Geopolitical Tension

In times of rising geopolitical tension or outright conflict, defense stocks often outperform the broader market as gove...

Circle-Coinbase Partnership in Focus as USDC Drives Revenue Surge

As Circle Internet (NYSE:CRCL) gains attention following its recent public listing, investors are increasingly scrutiniz...

LVMH Moët Hennessy Louis Vuitton (OTC:LVMUY) Financial Performance Analysis

LVMH Moët Hennessy Louis Vuitton (OTC:LVMUY) is a global leader in luxury goods, offering high-quality products across f...