FMP

How To Pick Stocks Using Financial Ratios

Sep 30, 2022

Disclaimer : Any recommendation is based on the analysis described and is given to illustrate this method of picking stocks. Financial Modeling Prep and their writers won't be responsible for your profit or loss

Putting money into the stock market is a great way to grow your money. There are numerous methods to analyze and invest in stocks. There is no standard procedure to go about picking stocks and it's a highly subjective art. Everyone has their own unique philosophy. It's good to understand the basics and then develop your own strategies. Given that the world of finance is driven by numbers, it's straightforward and important to consistently iterate your strategy and compare the results.

However, in this different part of this article, you're going to learn a simple and effective way to shortlist stocks for investment. The aim is for it to be simple enough for anyone to understand and particularly for those with little to no financial knowledge. Of course, we also hope the simplicity won't take away from the effectiveness of strategy.

Part 1: An Introduction to using shortlisting stocks and some key financial ratios.

In this part we will:

- Provide an overview of the stocks we're going to assess

- Introduce 6 key ratios

1. Which Stocks Will We Review?

Throughout this article we will be trying to determine which stocks are the best to buy at the moment. For this example, I will be analyzing 5 companies in the renewable energy sector. I have a hunch that companies in this space are a good long term bet as economies transition away from fossil fuels and toward renewable alternatives. They are all good stocks with potential for growth in the future.

I've taken the following stocks from the renewable energy sector for my analysis.

1. SunPower Corp. | SPWR

Enphase Energy is a NASDAQ-listed energy technology company headquartered in Fremont, California. Enphase designs and manufactures software-driven home energy solutions that span solar generation, home energy storage and web-based monitoring and control.

2. Enphase Energy Inc | ENPH

SunPower Corporation is an American energy company that designs and manufactures crystalline silicon photovoltaic cells and solar panels based on an all-back-contact solar cell invented at Stanford University.

3. JinkoSolar Holding Co Ltd | JKS

JinkoSolar Holding Co., Ltd., together with its subsidiaries, engages in the design, development, production, and marketing of photovoltaic products. The company offers solar modules, silicon wafers, solar cells, recovered silicon materials, and silicon ingots. It also provides solar system integration services and develops commercial solar power projects.

4. Canadian Solar Inc | CSIQ

Canadian Solar Inc., together with its subsidiaries, designs, develops, manufactures, and sells solar ingots, wafers, cells, modules, and other solar power products. The company operates through two segments, Module and System Solutions (MSS), and Energy.

5. Renewable Energy Group Inc | REGI

Renewable Energy Group Inc. produces biofuels and renewable chemicals. The Company develops, distributes, sells, and provides logistics for biodiesel and renewable chemical production. Renewable Energy Group serves companies throughout the United States.

All of these companies belong to the renewable energy sector

2. How Will We Analyse These Stocks?

So we have a list of good looking stocks that we've picked from a sector that we're interested in. Now we need to find a reliable way of comparing them so that your money is invested wisely. First, it's important to note that we'll only be dealing in numbers from now on. This is because primarily numbers don't lie, they are hard facts (unless the company is misreporting but that's highly illegal), and because it makes it straightforward to compare against each other. As was already mentioned, there is no standard procedure for picking stocks but the financial ratios I'm about to give are a great place to start. Even if you just use these financial ratios, you'll be able to choose high quality stocks from any sector you wish!

Generally speaking, the aim of the game is to pick stocks with solid fundamentals at a good price. This sounds easy but if it was then you probably wouldn't be working right now and neither would I! However, the stock market has a seemingly endless supply of stocks to invest in and it's up to us to find them to be able to capitalize on the opportunity!

So you probably want me to get to the point and tell you which financial ratios to use… This method of investing uses the following 6 financial ratios/parameters:

- PE ratio ( Price-Earning ratio)

- 52 week low/52 week high

- ICR ( Interest coverage ratio)

- ROE ( Return on equity )

- ROCE ( Return on capital employed )

- PBV ( Price to book value )

As you'll notice on the Financial Ratio section of any company in the FMP database, there are 10s of ratios that you could use to compare stocks. When you're developing your own strategies in the future, look to use more ratios by thinking about what the ratio tells you and how that can be used to inform your strategy.

Rounding Up

In this Part, we went over the high level basics of stock shortlisting. In summary, you want to find well run companies that have potential for growth and are trading at a good price. Once you find some companies that meet those criteria, you want to use numeric information to compare the stocks you've chosen to be able to pick the stock most likely to succeed.

Part 2: How to use PE, 52 week low/high, and ICR to pick stocks.

In this Part 2 , we will be reviewing three key quantitative factors that you can find out about a stock and then use to make investment decisions. They are:

- Price to Earnings Ratio

- 52 Week High/Low

- Interest Coverage Ratio

1: PE ratio

I'm not discussing the formula here, rather we'll see what the ratio means and how we apply this in our analysis.

The PE ratio (learn more about PE ratio in this article) is a valuing ratio that measures the firm's current share price relative to its per-share earnings. We're going to look at the PE of the companies mentioned above and compare its individual PE with the Alternate Energy Industry PE. When we compare the individual PE with the Industry PE, we will come to know which stock is undervalued or which stock is overvalued or which stock is fairly valued. Now, all the stocks mentioned are good stocks. So which stock/s should we be interested in?The stocks that should ignite our attention are those which are currently undervalued, and, therefore have good future upside potential

We can perform the above analysis with the help of this image below :

Firstly, let's investigate the industry average. The industry PE of the Renewable Energy Sector is 18.55. But what does it mean?The industry average PE says that if a company in the renewable energy sector earns $1 per share, then an investor is willing to pay $18.55 to buy the stock.

Now, let's take a look at the Individual PE of all the stocks and compare it with the industry average PE to determine which of the stocks we've selected are undervalued.

The stock with the lowest PE is the one which is most undervalued. In this case, the stock with the lowest PE is Renewable Energy Group at 2.62, closely followed by Canadian Solar and JinkoSolar who have PE ratios of 5.15 and 5.17 respectively. These stocks all have PE ratios significantly below the industry average and are therefore considered to be undervalued.

The highest PE belongs to SunPower at 37.06. This PE ratio is double the industry average meaning that SunPower is overvalued at the moment. Remember, we are looking for stocks that are undervalued and have a good upside potential. So, though this wouldn't rule it out as an option for all investors, this particular strategy doesn't favour overvalued stocks. We're going to rule out SunPower for the rest of our analysis. You'll also notice that Enphase Energy has a PE ratio of 24.26 which is higher than the industry average. Therefore, we won't continue to analyse ENPH in this analysis.

Can we lock in a stock just by looking at it's PE? NO.

There are other 5 factors to bear in mind which we will check now before we draw any conclusions.

2: 52 week low

The 52 weeks high and low of a stock typically shows how resilient a stock is and how well it fares to varying conditions. There could have been some negative news about the company that causes its stock price to fall and make a new low. Vice versa for the 52 week high, there was most likely some positive news about the company which investors reacted to. An example of positive news might be release of quarterly financial statements which show higher than forecasted earnings. On the other hand, an example of negative news could be a company's product/service failing to produce the results expected.

There is a good opportunity to buy a stock when it is undervalued and near to its 52 week low, provided the financial fundamentals (which we will come to later) are sound.

Let's check out the 52 week high/low and the current market price of the three stocks that are left in our analysis:

All three stocks have a current market price that is incredibly close to the 52 week high. What's going on here?

Whenever you're making investment decisions it is crucial to have a pulse on what is happening in the general stock market and the global economic situation. As we all know, 2020 has been a turbulent year for the stock markets because of the Coronavirus pandemic. The pandemic caused the biggest stock market crash since the Great Depression in the 1930s and was preceded by record highs. At the time of writing, the markets are back at record highs. Though individual stocks generally act according to the company's performance, they are also massively influenced by the market conditions around them. At this time, it means that the 52 week high/low is futile in our analysis. However, I've left it in this article because it is ordinarily a valuable metric to examine.

We will continue with the rest of our analysis using the three stocks that made it through the PE section.

3: Interest coverage ratio ( ICR )

This is very important when it comes to stock picking. In fact, this is the first thing I see before looking at other factors. If ICR is strong, more often than not, the stock turns out to be really good.

The next step in our analysis is to investigate the current and historical interest coverage ratio of the stocks. ICR is calculated by dividing the operating profit (or EBIT) by interest expense, and measures the company's ability to pay off its interest on any loans that have been taken. What we find is that if ICR is strong, more often than not, the stock will be a good investment. With ICR the higher the figure the better. A strong ICR means that a company can fulfil their interest obligations provided they have good earnings before interest and tax.

ICR usually means the companies ability to pay off its interest ( repayment of interest on loan taken) obligations. More the better. A company can fulfil it's interest obligations provided it has good earnings before interest and taxes.

Here's a hypothetical earnings statement :

where EBIT is earnings (Sales - Costs) before interest and taxes

EBT is earnings before tax after paying off the interest and

PAT is Profit after tax, profit after paying the interest and tax.

The higher the EBIT, generally higher the ICR. EBIT is also called the operating profit, profit earned by the company from its business operations before interest and tax commitments.

Let's take a look at the ICR of the above-mentioned companies:

We also want to review the historical ICR of these companies:

The standout stock from this analysis is REGI with a 2019 ICR of 32.86. This is a remarkable increase given the -2.99 in 2017 and -13.04 in 2015.

CSIQ has trended up over the past 5 years which is a good sign, but a current ICR of 3.18 is significantly lower than the REGI ICR. JKS has a current ICR of 0.03 and no real change of the past 5 years. This is somewhat concerning as signals limited growth in the profitability of the company over the past 5 years. For that reason, we'll no longer consider JKS in this analysis.

Rounding Up

In this part 2 of the series we learned about how to use three different parameters to weigh up which stock to invest in. We learned that when looking at PE ratios it is important to compare a company's PE ratio to the industry average, how to use the 52 week high/low, and finally how to calculate and use the ICR ratio. The last part of this series will look at the last two pieces of the puzzle to make a good investment decision

Part 3: How to use ROE, ROCE, and Price to Book value to pick stocks.

In the last part we reviewed PE ratio, 52 weeks high/low, and interest coverage ratio. In this part 3, we will be reviewing three more quantitative factors that you can calculate about a stock and then use to make investment decisions. They are:

- 4. Return on Equity

- 5. Return on Capital Employed

- 6. Price to Book Value

4: ROE/ROCE

Return on Equity calculates how much money is made based on the investors' investment in the company. Investors want to see a high return on equity ratio because this indicates that the company is using its investors' funds effectively. Since Assets = Liabilities + Equity , ROE gives deeper insight into specifically how well the company generates profit in comparison to the value of the equity held; ROE is also considered the return on net assets because Equity = Assets - Liabilities.

ROCE shows investors how many dollars in profits each dollar of capital employed generates. By doing so, it measures the profitability of a company and how well it employs its capital.This is particularly helpful when looking at a firm with heavy capital investments. What this means is that the company has a lot of assets and a lot of debt, such as resource companies or utilities. Unlike ROE, ROCE looks at debt and other liabilities as well as equity. What is of particular value is looking at the historic trend; investors like to see a ROCE that is stable and growing. Of course, compare ROCE calculations to other companies and the industry average.

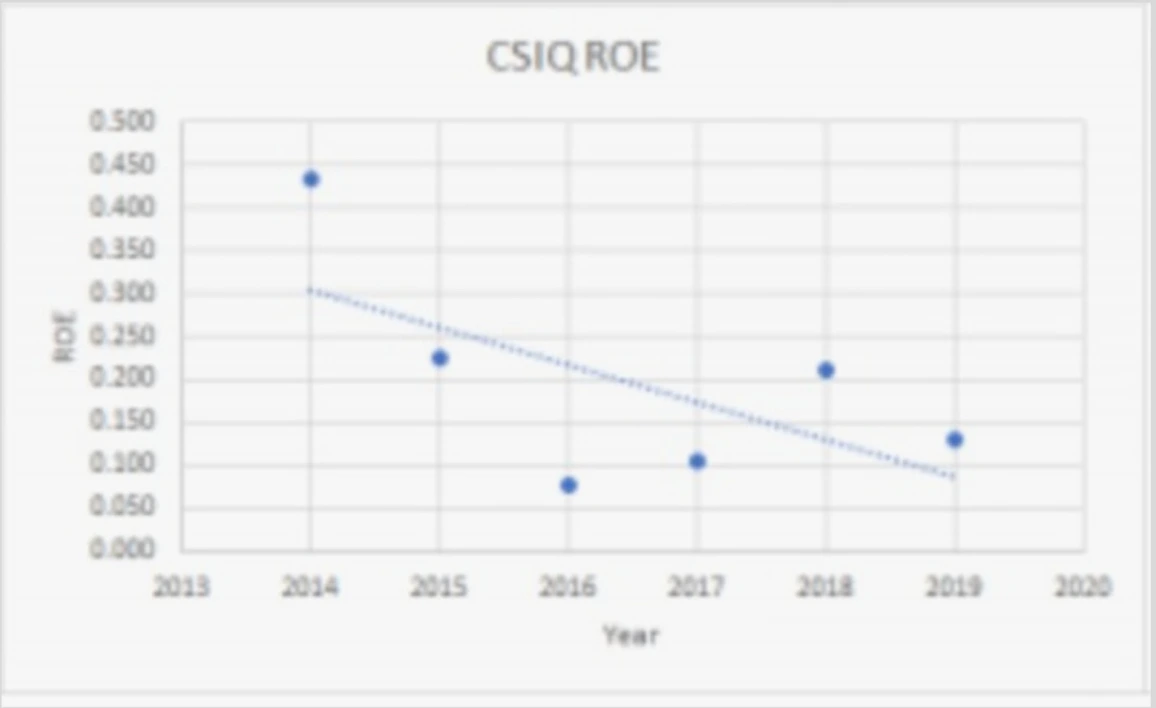

Both, the higher the better. Also, what I see is the past 5 years trend of both ROE and ROCE. Fluctuations are okay unless there is too much deviation which will require further and deeper analysis.

With these two ratios, it's a case of the bigger is better. However, consistency over the past 5 years is arguably more important. Fluctuations certainly aren't the end of the world but this would give us reason to investigate further.

Again, we're not looking for a specific percentage rather we're looking for consistency

Let's have the look at the ROE and ROCE of Renewable Energy Group and Canadian Solar Inc - the two remaining companies in our analysis.

Here I have produced a graph of the ROE and ROCE of both companies over the past 5 years.

We can see that neither company has been truly stable over that period of time but CSIQ has experienced smaller fluctuations and never dropped into the negatives. Worryingly, REGI experienced two years of negative ROE and ROCE, but it has produced outstanding figures in the past two years.

The fluctuations that REGI have undergone warrant further examination. After doing research on Google I've determined that the changeable business results that REGI have produced have been caused by uncertainty in the federal tax credit revenue they receive because they are a renewable energy company. It seems that the uncertainty has ended (for the meantime) and this explains the great results over the past two years.

Because of the recent swings in ROE and ROCE for REGI, CSIQ is slightly ahead in this stage of our analysis.

Now we'll move into the final piece of our analysis of these two companies.

5: Price to book value ( PBV ratio )

This ratio compares the company's stock price or market value to the book value per share. In contrast, book value is the net asset value of a company. Imagine a company liquidated all of its assets and paid off all its debt, all that would remain is the book value. The price to book value ratio shows the amount that shareholders are paying for the net assets of any company. Remember that market value is generally higher than the book value because it is a forward looking metric based on future cash flows (amongst other factors). A p/b ratio of 1 is considered as a stable ratio.

Price to Book Value = Market price per share/ Book value per share.

Book value per share = (Total Common Shareholders Equity - Preferred Stock) / # Common Shares

So the Price to Book Value means the price an investor has to pay for 1 dollar of worth in the company.

It is similar to PE where PE is a price an investor has to pay for 1 dollar of earnings in the company.

In PE, it's comparing market price against the earnings. In PBV, it's comparing against worth. Similar to PE, with PBV the lower the better

Let's have a look at the PBV of the companies before we draw a conclusion:

What we see here is that both stocks have Price to Book values that we like to see as investors. As mentioned, with PBV the lower the figure the better so the REGI stock has marginally better position in this part of the analysis. However, the PBV of CSIQ is at exactly 1 which tells us that it should make a solid investment as well.

Now to summarize everything we've discovered about these two stocks throughout this analysis.

It looks pretty clear that REGI is the best option to invest in. The only slight concern is around the instability of ROE and ROCE but this is reasonably explained by the uncertainty around federal tax credits which has now been reduced. With that being said, the fundamentals of CSIQ are solid and it could be prudent to invest in both stocks to somewhat diversify the risk within this sector.

Disclaimer : This is merely a recommendation based on the above analysis. I won't be responsible for your profit or loss.

Rounding Up

These parameters are more than enough for you to learn and get started with investing. Of course, there are lots of other factors that can be considered before investing in a particular stock which I hope to share with you in the near future.

In this article series you should have learned about how to use the following five parameters to make an investment decision:

- Price to Earnings Ratio

- 52 Week High/Low

- Interest Coverage Ratio

- Return on Equity

- Return on Capital Employed

- Price to Book Value

To start practicing, take any sector and calculate the ratios of some companies you find interesting. As always at FMP, please feel free to get in touch if you have any questions or want to provide us any feedback!

Happy Investing :)

Disclaimer : Any recommendation is based on the analysis described and is given to illustrate this method of picking stocks. Financial Modeling Prep and their writers won't be responsible for your profit or loss.

MicroStrategy Incorporated (NASDAQ:MSTR) Earnings Preview and Bitcoin Investment Strategy

MicroStrategy Incorporated (NASDAQ:MSTR) is a prominent business intelligence company known for its software solutions a...

WACC vs ROIC: Evaluating Capital Efficiency and Value Creation

Introduction In corporate finance, assessing how effectively a company utilizes its capital is crucial. Two key metri...

BofA Sees AI Capex Boom in 2025, Backs Nvidia and Broadcom

Bank of America analysts reiterated a bullish outlook on data center and artificial intelligence capital expenditures fo...