Why News Sentiment Alone Is a Terrible Investment Signal

Jan 18, 2026

News sentiment has become one of the most popular data signals in modern investing. Traders scan headlines, quantify emotions, and try to convert optimism or fear into buy and sell decisions. On the surface, this approach feels logical. Markets react to news, and news carries sentiment. So sentiment should predict price—right?

In reality, this assumption breaks down quickly.

News sentiment reflects how stories are written, not how capital moves. It reacts to events that markets often price in long before headlines turn bullish or bearish. Positive sentiment can coexist with declining fundamentals, weak volume, or institutional selling. Negative sentiment can appear right at market bottoms, when smart money is already accumulating.

Relying on news sentiment alone often leads investors to chase moves too late, misread risk, or confuse media noise with genuine opportunity. To understand why sentiment fails as a standalone signal, we need to look at what it measures, what it ignores, and how markets actually respond to information.

This article breaks down why news sentiment by itself is a terrible investment signal, and how it becomes useful only when combined with price action, volume, and fundamentals using structured market data from Financial Modeling Prep.

What News Sentiment Actually Measures

News sentiment reflects how stories are written and framed, based on the language used in headlines and articles. Words like strong growth or beats estimates push sentiment up. Terms like miss, cut, or risk drag it down. This tells you the tone of coverage, not the direction of capital.That distinction matters.

The media reacts after events unfold. Headlines follow price moves, earnings releases, or macro shocks. By the time sentiment shifts, markets have often already adjusted. Sentiment ends up reflecting narrative momentum, not opportunity.

Another issue is context blindness. Sentiment scores don't know whether good news was already priced in. They can't separate a major earnings surprise from a low-impact opinion piece. All signals get mixed into one score, increasing noise.

In practice, sentiment highlights what's being talked about, not what should be traded.From a data standpoint, this is exactly what FMP's Stock News API provides—clean access to structured news content, not trading signals by default.

Used alone, sentiment misleads. Used correctly, it becomes supporting evidence.To make this concrete, the below python code shows how investors typically pull raw news data before applying any sentiment logic. This is the unprocessed input that sentiment models rely on.

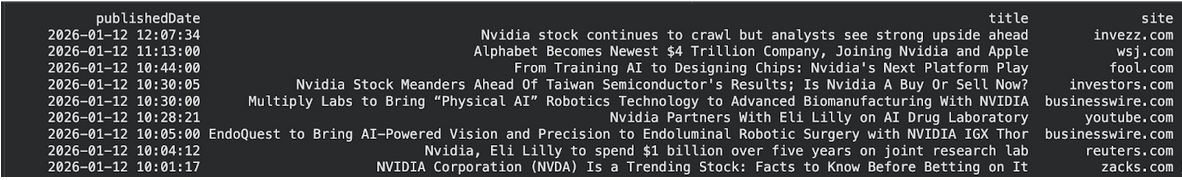

|

import requests import pandas as pd API_KEY = "YOUR_API_KEY" BASE = "https://financialmodelingprep.com/stable" def fmp_get(path: str, params: dict | None = None): params = params or {} params["apikey"] = API_KEY url = f"{BASE}{path}" r = requests.get(url, params=params, timeout=30) r.raise_for_status() return r.json() # Section 1: Pull company-specific news (raw input for sentiment) symbol = "NVDA" news = fmp_get("/news/stock", {"symbols": symbol}) df_news = pd.DataFrame(news)[["publishedDate", "title", "site", "url"]].head(10) print(df_news.to_string(index=False)) |

This output highlights an important limitation:

Sentiment models analyze headlines and language, not whether the news actually changed market positioning.

Next, let's address the biggest flaw of sentiment-based investing: it's always late.

The Structural Timing Gap Between Prices and Headlines

Markets don't wait for journalists.

Prices react the moment new information hits the system—earnings numbers, guidance shifts, macro data, or institutional orders. News articles appear later, once the move is already visible. Sentiment forms after price discovery begins. That delay is structural. By the time sentiment turns positive, early buyers are often done buying. When sentiment turns negative, the sell-off may already be near exhaustion. Sentiment doesn't catch the start of a move; it explains it retroactively.

This is why sentiment-based strategies struggle with timing. They enter late, exit late, and mistake explanations for predictions. Price data makes this obvious when market signals are examined systematically rather than inferred from headlines.

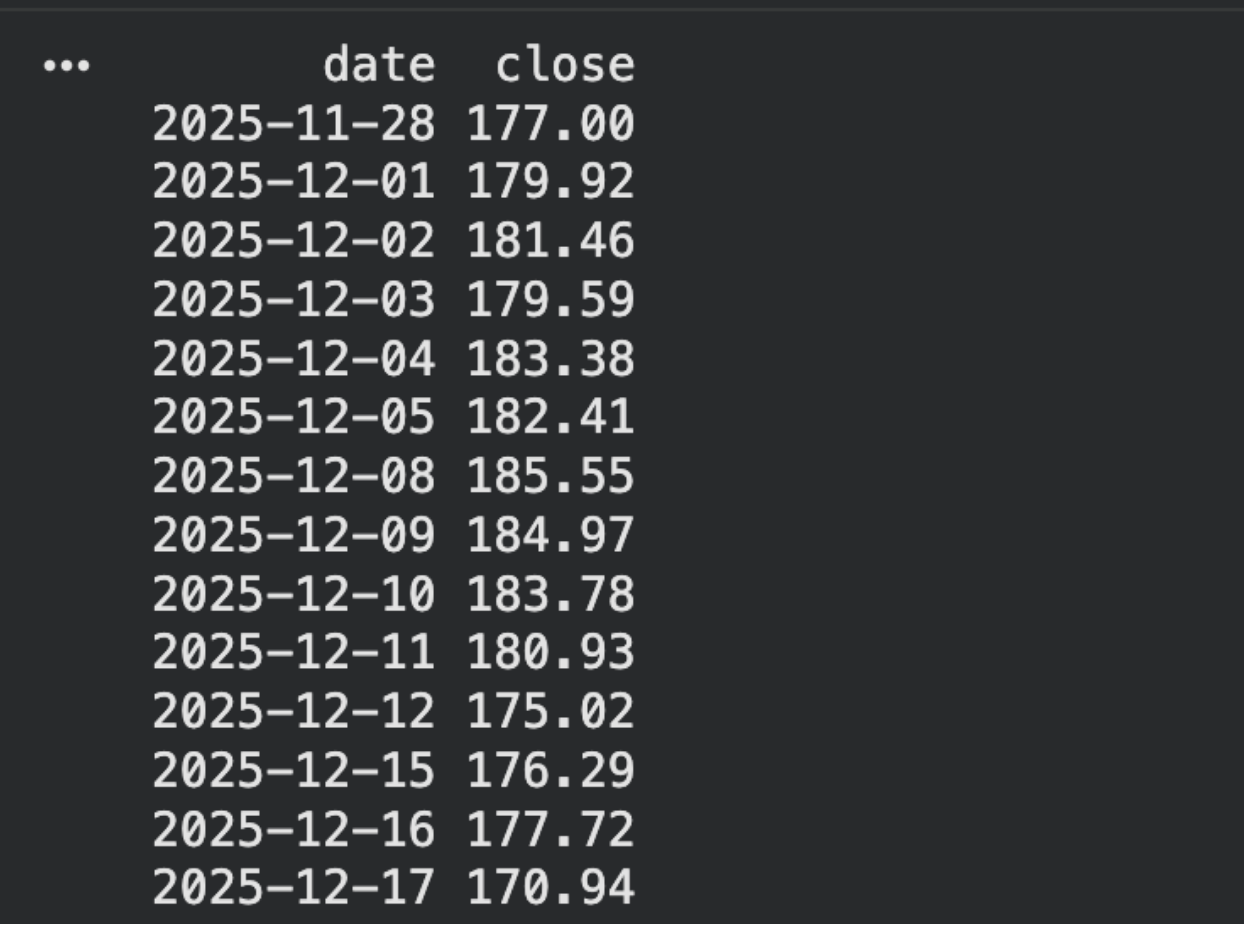

The snippet below pulls recent price history to show how market moves often begin before sentiment shifts in news coverage.

|

import requests import pandas as pd API_KEY = "YOUR_API_KEY" BASE = "https://financialmodelingprep.com/stable" def fmp_get(path: str, params: dict | None = None): params = params or {} params["apikey"] = API_KEY url = f"{BASE}{path}" r = requests.get(url, params=params, timeout=30) r.raise_for_status() return r.json() # Section 2: Pull price history (close) and take last 30 rows symbol = "NVDA" prices = fmp_get("/historical-price-eod/full", {"symbol": symbol}) df_px = pd.DataFrame(prices) df_px["date"] = pd.to_datetime(df_px["date"]) df_px = df_px.sort_values("date").tail(30)[["date", "close"]] print(df_px.to_string(index=False)) |

When price changes appear before headlines turn positive or negative, sentiment becomes an explanation—not a signal.

Sharp moves often appear days before headlines change tone. News doesn't lead the market. It narrates what already happened.To see this clearly, you need raw price history—not commentary—pulled directly from historical market data.

Price tells you when the market decided.

Sentiment tells you how it was explained.

Next, we move to what sentiment completely ignores: where real money actually goes.

Why Sentiment Fails to Reflect Capital Commitment

Markets don't respond to sentiment in isolation. They respond to capital commitment.

A stock can attract positive headlines and optimistic commentary while seeing very little real money flow into it. When sentiment improves without a corresponding rise in volume, it usually reflects attention rather than conviction.

Capital flow tells a different story. When institutions build positions, volume expands, liquidity improves, and price movements gain depth. These dynamics reveal participation and intent, yet none of them are visible in sentiment scores alone.

The opposite pattern appears just as often. Negative headlines may dominate coverage while volume quietly increases. In many cases, that reflects accumulation rather than fear, as informed capital steps in before narratives change.

This gap matters. Sentiment reacts to what people say. Volume reveals what they do. To track participation, you need real-time market data that captures both price and volume—not headlines.

This endpoint exposes daily volume alongside price, making it easy to separate noise from genuine interest.

Next, we'll step away from markets entirely and focus on what headlines never change: the underlying business.

Business Fundamentals Operate Independently of News Cycles

Headlines tend to change quickly as narratives shift, but underlying business performance follows a much slower and more deliberate path.

News sentiment can swing daily or even hourly, while revenue growth, margins, and cash flow evolve across quarters and years. It's common to see a positive news cycle persist even as fundamentals quietly weaken, or sustained negative coverage continue while operational performance begins to stabilize. This disconnect is where sentiment often misleads long-term investors.

Media optimism often ignores shrinking margins, rising debt, or slowing growth. Negative coverage can also miss early signs of recovery buried inside financial statements. Sentiment reacts to stories. Fundamentals reveal reality.

Strong businesses compound value even when sentiment fades. Weak businesses eventually break, no matter how positive the narrative sounds.To evaluate this properly, you need structured financial data—not opinion—directly from company financial statements.

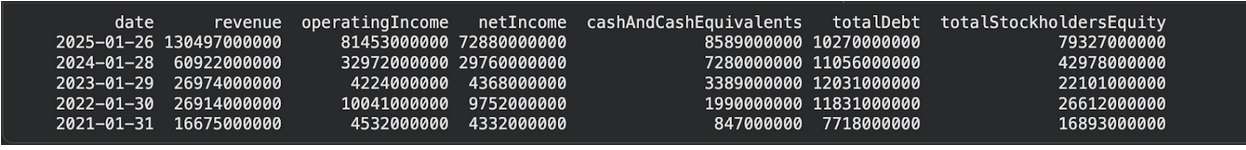

The below python code pulls core financial statements to illustrate how business performance evolves independently of news sentiment.

|

import requests import pandas as pd API_KEY = "YOUR_API_KEY" BASE = "https://financialmodelingprep.com/stable" def fmp_get(path: str, params: dict | None = None): params = params or {} params["apikey"] = API_KEY url = f"{BASE}{path}" r = requests.get(url, params=params, timeout=30) r.raise_for_status() return r.json() symbol = "NVDA" # Income statement (profitability) inc = fmp_get("/income-statement", {"symbol": symbol}) df_inc = pd.DataFrame(inc) # Balance sheet (stability) bs = fmp_get("/balance-sheet-statement", {"symbol": symbol}) df_bs = pd.DataFrame(bs) # Keep it crisp: show only what supports the point inc_cols = ["date", "revenue", "operatingIncome", "netIncome"] bs_cols = ["date", "cashAndCashEquivalents", "totalDebt", "totalStockholdersEquity"] df_fund = ( df_inc[inc_cols] .merge(df_bs[bs_cols], on="date", how="inner") .sort_values("date", ascending=False) .head(5) ) print(df_fund.to_string(index=False)) |

These fundamentals change slowly and systematically, which is why sentiment alone cannot capture long-term business reality. Revenue trends, profitability, asset quality, and balance sheet structure ultimately drive long-term returns, regardless of how the narrative shifts in the short term.

With fundamentals established, we can now look at the limited situations where sentiment adds value—and why it should never lead a trade.

The Correct Role of Sentiment in a Data-Driven Investment Process

Sentiment can add value when it is used in the right part of the investment process, rather than treated as a primary signal.

It tends to be most informative after something concrete has already occurred, such as an earnings surprise, a change in guidance, or a confirmed price move. In these situations, sentiment helps assess how the market is interpreting new information, not whether an opportunity exists.

When fundamentals improve and price action confirms that improvement, rising positive sentiment often signals broader acceptance of the move. Conversely, when results disappoint and sentiment turns sharply negative, it usually reflects consensus forming around outcomes that the market has already begun to price in.

Viewed this way, sentiment answers a narrower and more practical question: whether market participants are aligning with the underlying data. It is far less reliable as a tool for deciding when to initiate a position.

Earnings events provide the clearest illustration of this relationship. Financial results establish the facts first, and narratives develop afterward as investors react to those outcomes.

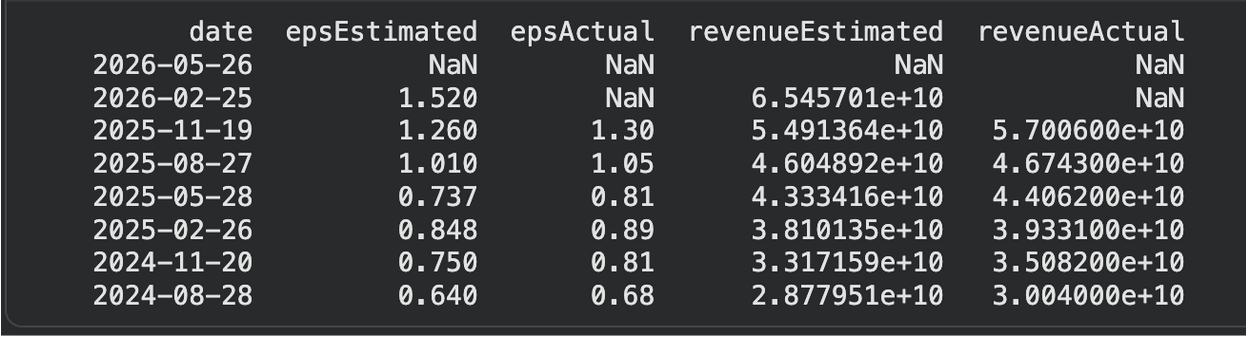

The snippet below shows how earnings data provides factual anchors before sentiment forms around the results.

|

import requests import pandas as pd API_KEY = "YOUR_API_KEY" BASE = "https://financialmodelingprep.com/stable" def fmp_get(path: str, params: dict | None = None): params = params or {} params["apikey"] = API_KEY url = f"{BASE}{path}" r = requests.get(url, params=params, timeout=30) r.raise_for_status() return r.json() symbol = "NVDA" earn = fmp_get("/earnings", {"symbol": symbol}) df_earn = pd.DataFrame(earn)[["date", "epsEstimated", "epsActual", "revenueEstimated", "revenueActual"]].head(8) print(df_earn.to_string(index=False)) |

Sentiment that emerges after earnings reflects interpretation rather than new information. Used as confirmation, it can strengthen conviction. Used as a trigger, it introduces unnecessary risk.

With sentiment placed in its proper role, we can now bring these signals together into a single, coherent framework using FMP data.

Building a Robust Signal Stack Using FMP Market and Financial Data

A robust investment process works best when signals reinforce one another rather than compete for attention.

It typically begins with fundamentals. Financial statements provide insight into business quality, financial resilience, and long-term sustainability. Price action then indicates whether the market is recognizing those fundamentals, while volume helps confirm whether capital is meaningfully committing to the move. Sentiment adds value only after these elements align, by reflecting how the narrative is forming around observable data.

The order in which these signals appear is important. When sentiment leads the process, it often introduces noise and mistimed decisions. When it follows fundamentals, price, and volume, it serves as confirmation rather than a source of bias.

Using a single, consistent data ecosystem strengthens this approach. With fundamentals, price data, volume, earnings, and news sourced from the same platform, analysts avoid the mismatches and timing gaps that can distort conclusions when signals are pulled from disconnected systems.

This framework focuses on filtering information rather than reacting to headlines. Sentiment provides context, while data remains the basis for decision-making.

Conclusion

News sentiment feels powerful because it's visible, fast, and emotional. But markets don't reward emotion—they reward data. Sentiment reacts to price moves, ignores capital flow, and overlooks business fundamentals. Used alone, it pushes investors late into trades and early out of conviction. The real edge comes from stacking signals in the right order: fundamentals first, price and volume next, sentiment last. With Financial Modeling Prep's unified market and financial APIs, sentiment stops being noise and becomes context—exactly where it belongs for investors building systematic, data-driven strategies. Access to datasets and pricing plans is available through the platform.

Top 5 Defense Stocks to Watch during a Geopolitical Tension

In times of rising geopolitical tension or outright conflict, defense stocks often outperform the broader market as gove...

Circle-Coinbase Partnership in Focus as USDC Drives Revenue Surge

As Circle Internet (NYSE:CRCL) gains attention following its recent public listing, investors are increasingly scrutiniz...

LVMH Moët Hennessy Louis Vuitton (OTC:LVMUY) Financial Performance Analysis

LVMH Moët Hennessy Louis Vuitton (OTC:LVMUY) is a global leader in luxury goods, offering high-quality products across f...