FMP

Python Simplified: Your Essential Finance Tool

Jan 10, 2024 6:19 AM - Parth Sanghvi

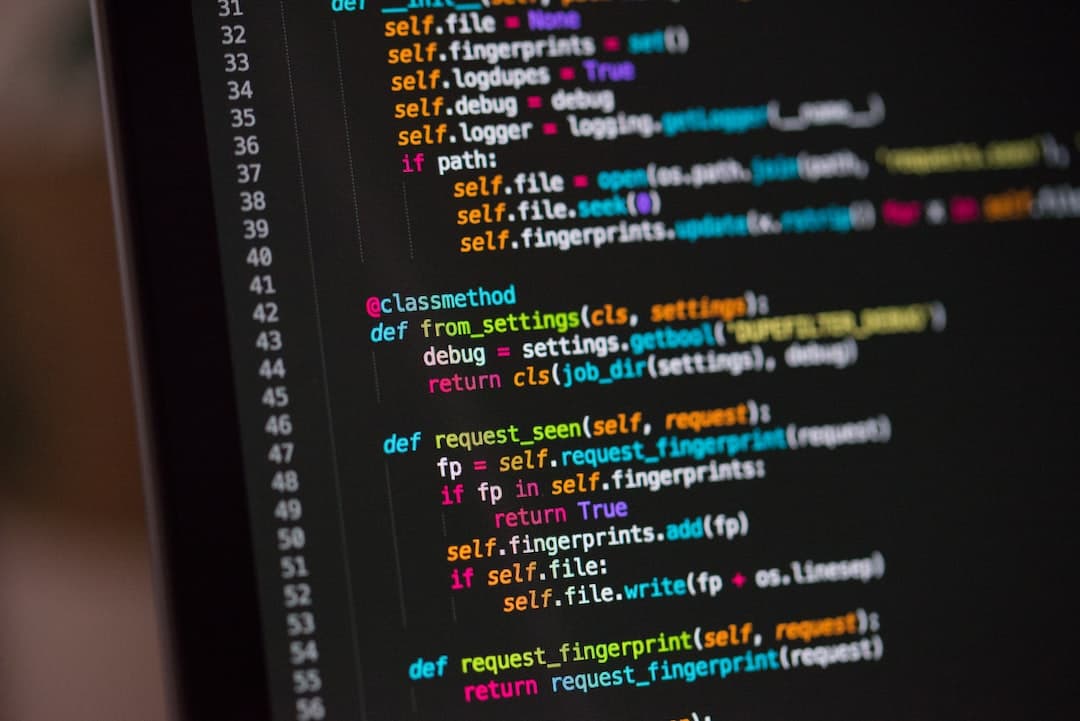

Image credit: Chris Ried

Other Blogs

Sep 11, 2023 1:38 PM - Rajnish Katharotiya

P/E Ratios Using Normalized Earnings

Price to Earnings is one of the key metrics use to value companies using multiples. The P/E ratio and other multiples are relative valuation metrics and they cannot be looked at in isolation. One of the problems with the P/E metric is the fact that if we are in the peak of a business cycle, earni...

Sep 11, 2023 1:49 PM - Rajnish Katharotiya

What is Price To Earnings Ratio and How to Calculate it using Python

Price-to-Earnings ratio is a relative valuation tool. It is used by investors to find great companies at low prices. In this post, we will build a Python script to calculate Price Earnings Ratio for comparable companies. Photo by Skitterphoto on Pexels Price Earnings Ratio and Comparable Compa...

Oct 17, 2023 3:09 PM - Davit Kirakosyan

VMware Stock Drops 12% as China May Hold Up the Broadcom Acquisition

Shares of VMware (NYSE:VMW) witnessed a sharp drop of 12% intra-day today due to rising concerns about China's review of the company's significant sale deal to Broadcom. Consequently, Broadcom's shares also saw a dip of around 4%. Even though there aren’t any apparent problems with the proposed solu...