FMP

Learn Financial Modeling (5/5): Discounted Cash Flow statement (DCF) Methodology

Sep 30, 2022(Last modified: Oct 16, 2023)

5. Discover our Intrinsic Value and its meaning

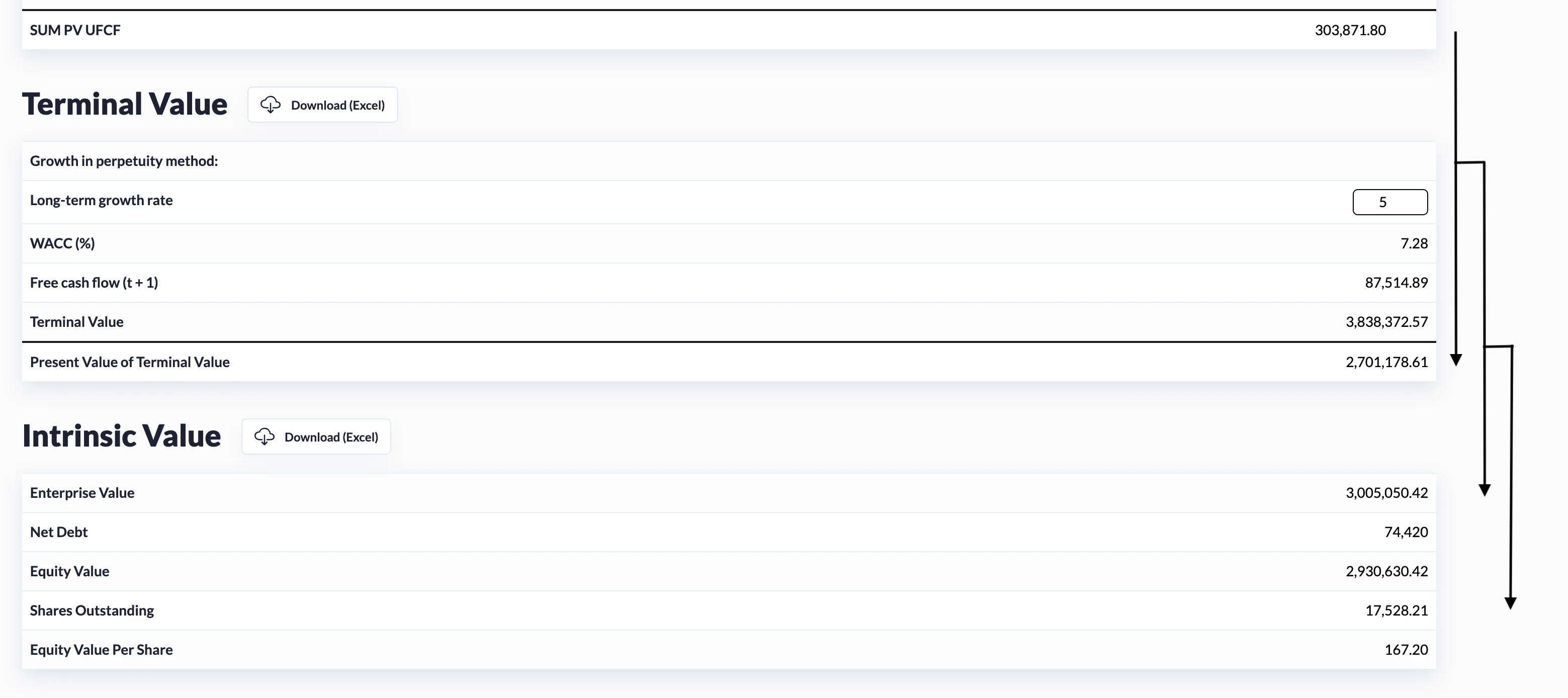

Enterprise value (EV) is a comprehensive measure of a company's total value that is frequently used in place of equity market capitalization because it includes debt. We could calculate enterprise value, which is the sum of stages one and two, but our concern is equity value.

We must make the transition from enterprise value to equity value. How are we to accomplish this? We must eliminate net debt. In other words, enterprise value less net debit equals equity value. We will calculate net debt using this formula.

I'm sure the majority of you believe we'll use standard debt. In fact, you would want to utilize all gross debt or non-equity claims. These items may include both gross debt and preferred stock minority interests.

Essentially, anything considered a non-equity claim that we wish to deduct from enterprise value to arrive at equity value. In this case, we're referring to net debt, which is defined as total debt less cash and cash equivalents.

The entire premise of Wall Street's net debt is that practitioners believe that they can repay some of their debt if they have excess liquidity. Assuming that, enterprise value less net debt equals our equity value. By incorporating our diluted share count, we can determine the equity value per share on a per-share basis.

Now we have an estimate of the equity value per share.This allows us to return to the Financial Summary and determine the recommendation.

Along with DCF Unlevered, you can see the stock's projected value with a strong sell recommendation. Now you can see how this robust analysis can be used to make investment or trading decisions, or whatever else you might be doing with DCF analysis.

To summarize:

For our explicit forecast period, we forecast free cash flows into the future.

Then, using a discount rate that reflects the riskiness of capital, we discount back to the present.

We employ WACC because we would like to utilize a discount rate available to all capital providers. This provided us with our stage 1 value.

Then, using a constant growth rate, we calculated stage 2, which is the value beyond the explicit forecast period.

Then, using WACC, this value was discounted back to the present. By combining stages 1 and 2, we arrived at the enterprise value.

We subtract net debt from enterprise value to arrive at equity value. We calculate the equity value per share by dividing the equity value by the number of diluted shares. To make a decision, we can compare this value to the stock market value.

Go back to discounted cash flow

Top 5 Defense Stocks to Watch during a Geopolitical Tension

In times of rising geopolitical tension or outright conflict, defense stocks often outperform the broader market as gove...

Circle-Coinbase Partnership in Focus as USDC Drives Revenue Surge

As Circle Internet (NYSE:CRCL) gains attention following its recent public listing, investors are increasingly scrutiniz...

LVMH Moët Hennessy Louis Vuitton (OTC:LVMUY) Financial Performance Analysis

LVMH Moët Hennessy Louis Vuitton (OTC:LVMUY) is a global leader in luxury goods, offering high-quality products across f...