The easiest way to calculate stock’s target price and why the target price is important.

May 14, 2024(Last modified: Nov 18, 2025)

A stock's target price, also known as its fair value, is an indication of what a share can cost based on the company's forecasted financial statements. It is important to know a stock's fair value to find undervalued stocks with great growth potential. Let's consider how investment analysts calculate a stock's fair value (or target price), and then I will show you the easiest and fastest way of calculating it.

Calculating a stock's target price is a very time-consuming process. Investment analysts forecast the company's free cash flow, the cost of money, and make various custom assumptions such as the inflation rate, debt burden, and revenue growth rate. The process requires diving deep into the company's financial statements, but that's not all. Analysts need to analyze competitors and the economic environment to make accurate forecasts. Analysts typically make forecasts for 10-15 years. You can read in more detail about how to calculate a stock's target price using one of the most popular models, the Discounted Cash Flow (DCF).

As you may see, calculating a stock's target price requires deep knowledge of financial statements and forecasting skills. The calculations may take up to several weeks as the data gathering process takes time. Unfortunately, not every trader is able to do this as not everyone has the time or required knowledge. Luckily, a better and faster option exists if you are a developer and trading stocks. You can use a great data provider like Financial Modeling Prep (FMP) to get the stock's target price for the selected stock in seconds. FMP uses premium endpoints with conservative assumptions to provide you with very accurate stock target price calculations. Don't worry if you don't have developer skills, I will lead you through the step-by-step process and you will be able to extract data and build your basic first web app using my guidance. Now let's consider how you can extract the stock's target price using FMP endpoints.

I will show you how to extract data using vanilla JavaScript, but if you use other programming languages, you can achieve the same with slight differences. Just remember the key principles that I am about to show you. I will write very simple code just to demonstrate how you can extract data using FMP and JavaScript.

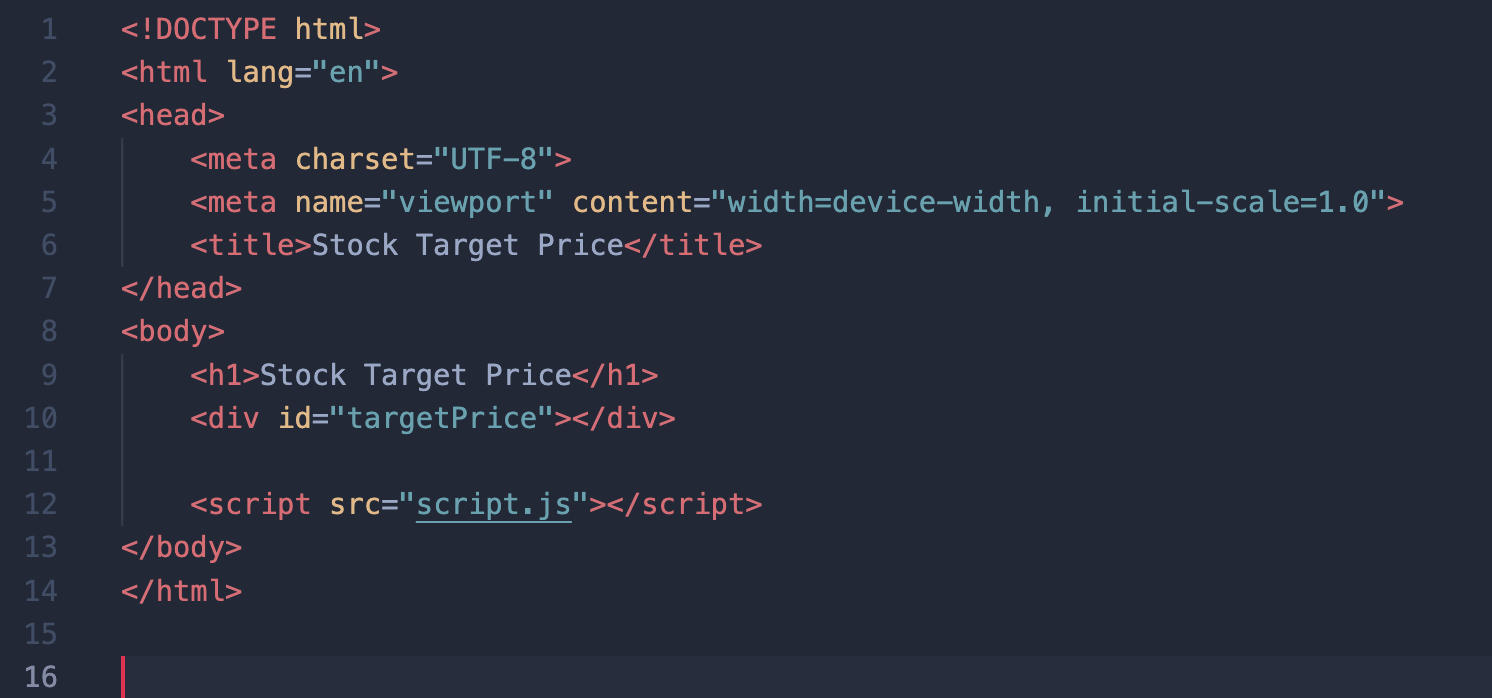

The first step is to open VSCode and create a basic HTML file using this code. Name file as you want but put “html” format after the dot, for example “testing.html” and write the below code.

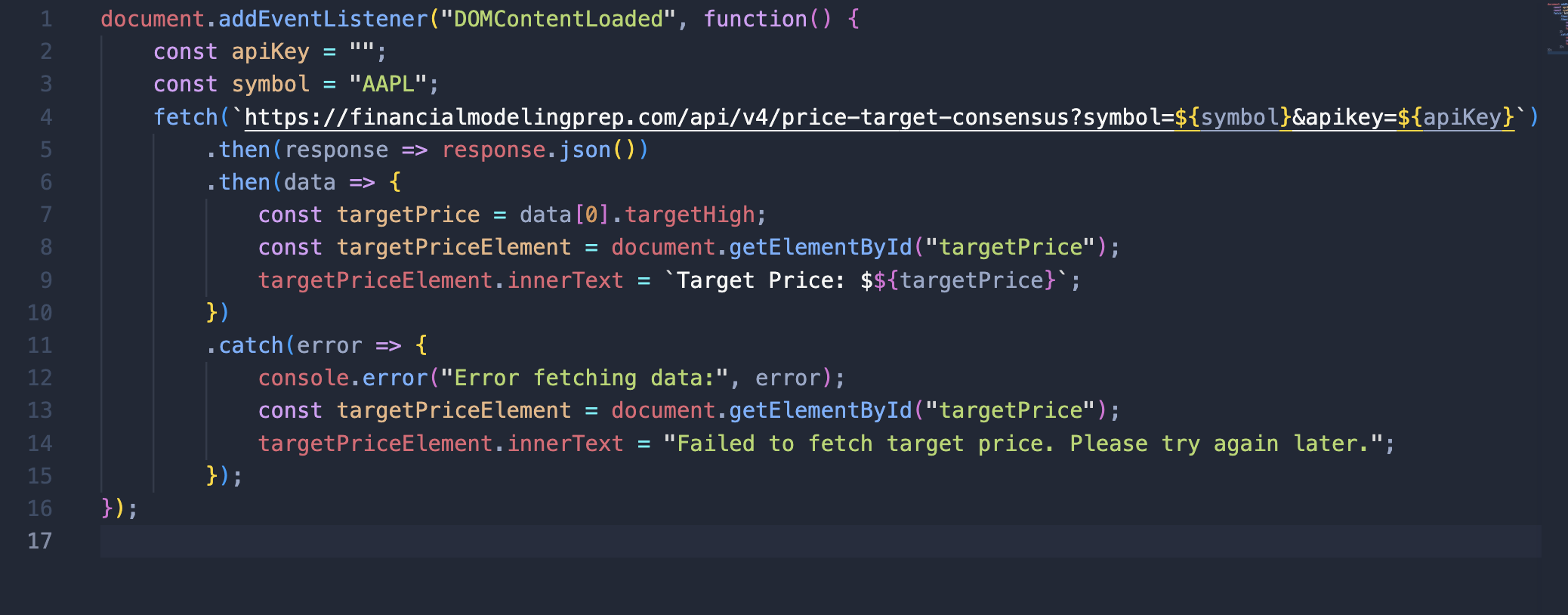

As you can see, we have a file called “script.js” inside your code, this is where our logic will be placed, and we will extract endpoints using this file. Now create another file, name it the same way “script.js” and put the below code in it

First, we wait for our HTML elements to load and then start fetching (extracting) the data. Put your own data in the apiKey section between the brackets. To get your API key, go to the FMP website, register, and obtain your custom API key.

In this example, we are using the AAPL stock ticker, but you can replace it with any ticker of your choice. Then we are extracting data using FMP endpoint and displaying the result on the screen.

The last step is to save your files, html and js and drag your html file to the browser (open your browser window and drag your file there), I am using Chrome, and you will see something like the picture below if you done everything correctly

Now you know how to extract a stock's target price even if you don't have investment analyst knowledge or if you are busy and have no time to calculate the stock's fair value manually. One important reminder before we finish, the stock target price is a premium endpoint, so you need a paid subscription to extract this information. However, I showed you a simple way of extracting amazing data, and there are plenty of free information that you can extract quickly using Financial Modeling Prep endpoints. Thanks for reading the article.

Top 5 Defense Stocks to Watch during a Geopolitical Tension

In times of rising geopolitical tension or outright conflict, defense stocks often outperform the broader market as gove...

Circle-Coinbase Partnership in Focus as USDC Drives Revenue Surge

As Circle Internet (NYSE:CRCL) gains attention following its recent public listing, investors are increasingly scrutiniz...

LVMH Moët Hennessy Louis Vuitton (OTC:LVMUY) Financial Performance Analysis

LVMH Moët Hennessy Louis Vuitton (OTC:LVMUY) is a global leader in luxury goods, offering high-quality products across f...