FMP

Measuring Governance Risk Factors Across Global Equities

Sep 22, 2025

Some of the biggest corporate collapses in history weren't triggered by weak earnings or shrinking margins—they were governance failures hiding in plain sight. Enron's accounting maze and Wirecard's phantom revenues blindsided investors, not because the numbers weren't there, but because oversight wasn't.

For analysts and risk specialists, that's the danger: governance risks are often buried in board structures, compensation schemes, or ownership models long before they erupt into scandals. And in today's interconnected markets, where standards vary dramatically between the U.S., Europe, and emerging economies, relying on manual, report-driven analysis is no longer enough.

This article shows how to shift from reactive investigation to proactive monitoring. By using financial APIs, analysts can turn opaque governance signals into standardized, comparable data—spotting red flags across global equities before the market prices them in.

The "G" Factor: Why Governance Is the Silent Killer

Governance the "G" in ESG is often the silent killer of a company's financial health. While easy to overlook, governance failures can lead to sudden, catastrophic meltdowns that blindside investors.

- Enron: A textbook case of poor governance, where a lack of oversight and an opaque board structure enabled accounting fraud that ultimately led to its collapse. The company's complex web of off-balance-sheet partnerships was a red flag that could have been identified with a closer look at its governance.

- Wirecard: This scandal revealed how a company can mislead auditors and regulators for years with a fraudulent business model, made possible by a lack of independent oversight and poor corporate culture. The fact that its governance systems failed to prevent such a massive fraud shows the importance of proactive risk monitoring.

- Dual-Class Shares: Governance risks can also be embedded in a company's structure. For example, a dual-class share structure like that of Meta allows a founder to retain outsized voting control even as their economic stake shrinks. This can limit the influence of public shareholders and create accountability issues.

These examples underscore a crucial point: governance failures are fundamental risks that cannot be spotted by looking at traditional financial metrics alone.

For analysts and risk specialists, assessing governance has traditionally been a tedious, manual process of poring over complex financial filings. But in a world of interconnected global markets, this reactive approach is no longer sufficient.

From Qualitative Reports to Quantifiable Data

Governance risk is often buried in lengthy disclosures, qualitative reports, and regulatory filings like proxy statements and 10-Ks. This is because factors like board independence or executive compensation structures are difficult to standardize.

- The Problem: Sifting through thousands of filings to manually track board diversity, compensation, and audit changes is impossible at scale. This often leads to risks being identified only after a major scandal breaks.

- The Solution: Modern APIs provide a standardized dataset that translates this complex, non-financial information into measurable, comparable metrics. This allows you to screen entire markets for potential risks in minutes, not months.

The Practical Workflow for Analysts

Here is a simple, three-step workflow to integrate governance risk monitoring into your analysis, without the need for complex technical modeling.

Step 1: The Initial Investigation: Screening the Headlines for Trouble

Before a deep dive, you need to identify which companies warrant further investigation.

- Action: Use a high-level API to screen a universe of companies for those with the lowest governance ratings.

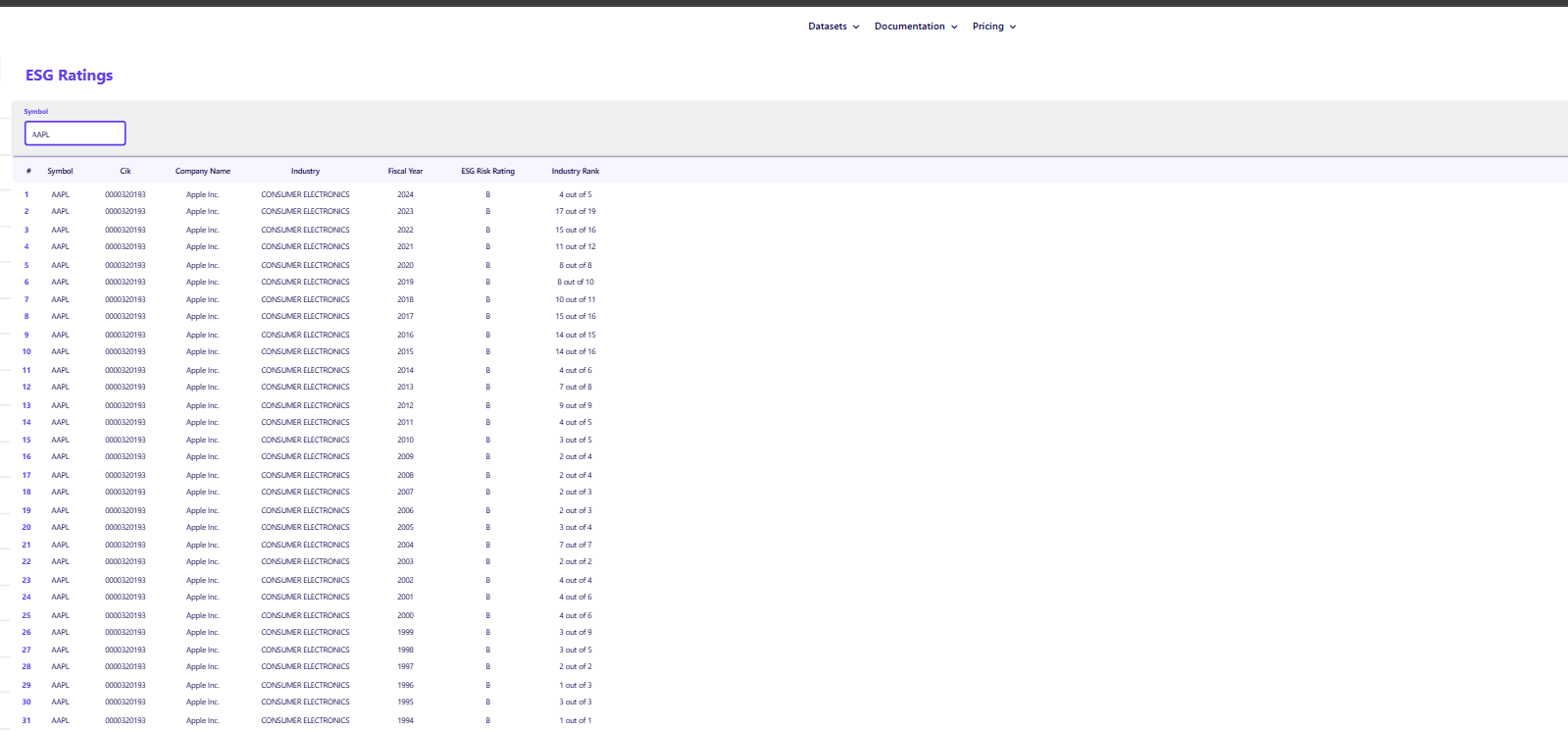

- Tool: The ESG Ratings API is ideal for this. It provides a simple, high-level rating (e.g., A, B, C) that reflects a company's overall governance performance. This allows you to quickly filter thousands of companies down to a manageable watchlist.

Step 2: The Deep Dive: Uncovering the "Why" Behind the Red Flag

Once you have a watchlist, you need to understand the why behind the low rating.

- Action: Pull a company's detailed governance sub-score and its underlying data points to pinpoint specific weaknesses.

- Tool: The ESG Search API provides a specific numerical score for a company's governance. It is a more granular view than a high-level rating and can expose issues such as:

- Board Structure: A lack of independent directors on the board.

- Executive Compensation: High executive pay that is not tied to performance metrics.

- Audit Oversight: A history of audit-related issues or restatements.

- Ownership Structure: Factors like dual-class shares that concentrate voting control.

Step 3: The Global Perspective: Putting the Pieces Together

The final step is to use the data to move from a reactive to a proactive position.

- Action: Compare a company's governance score to its peers to see if its risk profile is an industry-wide issue or a company-specific flaw.

- Insights:

- Relative Risk: A company's low governance score may be considered normal for its industry (e.g., a founder-led tech company in the U.S.), but the same governance score in a European bank could raise alarms.

- Global View: APIs enable you to consistently track governance risks across different geographies, which is critical for diversified portfolios. For instance, a founder-led tech company in the U.S. may be normal, but the same governance score in a European bank could raise alarms.

From Reactive to Proactive Risk Management

Governance risk is a silent but potent force in global markets. By moving away from manual, qualitative analysis and adopting a data-driven approach, analysts can use structured datasets from APIs to identify, track, and mitigate these risks at scale.

A governance risk framework works best when treated as a portfolio overlay, similar to building an ESG dashboard to monitor portfolio risks, where the goal is to highlight systemic weaknesses before they surface in financials.

Ultimately, a deep understanding of governance, coupled with a keen eye for risks like hidden liquidity issues, provides a more robust understanding of a company's true financial health. This proactive approach not only helps to protect a portfolio from sudden losses but also provides a deeper, more robust understanding of a company's true financial health.

The benefits are concrete and actionable: by identifying leaders with low-volatility governance structures, you can build a more resilient portfolio that is better positioned for long-term growth.

FAQs

What is governance risk?

Governance risk is the potential for financial and reputational loss resulting from a company's flawed corporate structure, lack of oversight, or unethical practices.

Why is governance considered the hardest ESG factor to quantify?

Unlike environmental data (like emissions) or social data (like employee diversity), governance factors are often qualitative and deeply embedded in a company's culture and internal processes, making them difficult to measure and compare.

How do APIs help with governance risk analysis?

APIs automate the collection of governance-related data from various sources and convert it into a standardized, quantitative format. This allows analysts to screen for risks and perform large-scale comparisons quickly and accurately.

Can governance risk be used for alpha generation?

Yes. Analysts who can effectively identify companies with strong governance are often rewarded with better long-term performance and lower volatility, as these firms tend to be more resilient and well-managed.

WACC vs ROIC: Evaluating Capital Efficiency and Value Creation

Introduction In corporate finance, assessing how effectively a company utilizes its capital is crucial. Two key metri...

BofA Sees AI Capex Boom in 2025, Backs Nvidia and Broadcom

Bank of America analysts reiterated a bullish outlook on data center and artificial intelligence capital expenditures fo...

Pinduoduo Inc. (PDD) Q1 2025 Earnings Report Analysis

Pinduoduo Inc., listed on the NASDAQ as PDD, is a prominent e-commerce platform in China, also operating internationally...