How to get Analyst Target Prices for Your Selected Stock and Which Target Price to Use for Assessing Stock Growth Potential

Jun 01, 2024(Last modified: Nov 18, 2025)

Today, I will demonstrate how you can access analyst target prices for your chosen stock and provide my recommendations on how to use these target prices correctly in your stock analysis. A stock target price is an analyst's projection of a stock's future price, based on factors such as company performance, market conditions, and financial metrics. Analysts typically use two main models to calculate stock target prices: the Discounted Cash Flow model (DCF) or the Dividend Discount Model (DDM). Understanding stock target prices is crucial because it helps you determine whether your chosen stock is undervalued, overvalued, or fairly valued, which can inform your trading decisions.

As a trader, you have three options for determining stock target prices:

1. Manually calculate the stock target price using the models mentioned above.

2. Use the consensus target price.

3. Select and use target prices from various investment analysts as references.

Today, we will focus on the third option: how to view stock target prices calculated by different investment analysts.

Before we start extracting target prices, let's consider why you might choose a particular analyst's target price and why seeing different analysts' prices is useful. Suppose you have been monitoring specific analysts whose estimates have consistently been accurate, with the stock market price reaching their projected targets. You might want to use their assumptions and target prices. Alternatively, you might trust a particular brokerage house or investment bank and prefer their analyst assumptions and target prices. Or you might have several favorite investment analysts and wish to extract their target prices, calculate an average price, and use this as your indicator for the selected stock. Knowing how to extract target prices from various analysts is therefore essential.

Now, let's see how we can do that using Google Sheets. Open Google Sheets, then install Financial Modeling Prep Add-On. Once the installation is complete, you can use FMP formulas.

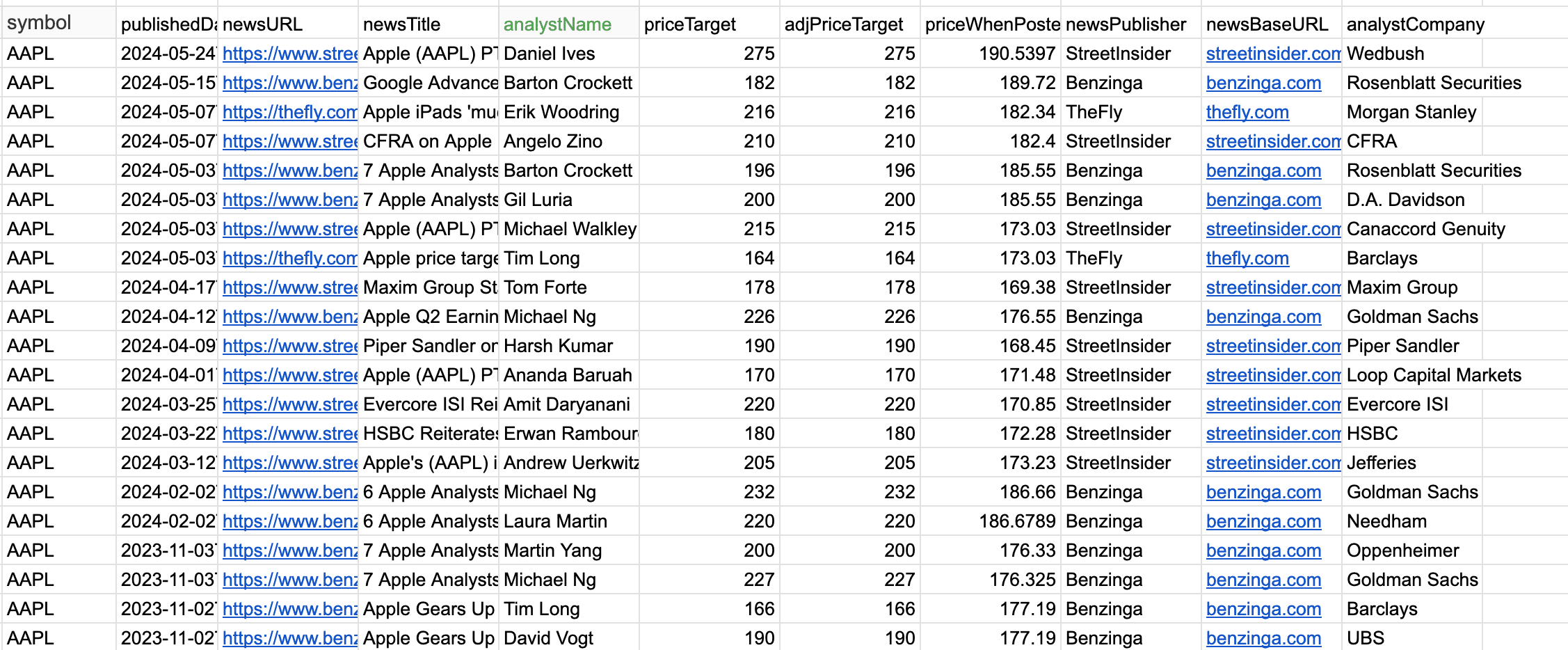

In an empty cell (any cell you choose), copy and paste the following formula: =fmpPriceTarget(“AAPL") Replace "AAPL" with the ticker symbol of your selected stock. If done correctly, you will see the below data displayed in the cell.

This method allows you to easily access and compare target prices from different analysts, enabling you to make informed trading decisions based on reliable data.

The data is sorted by dates. You have several options here. You can select the newest target prices for the last month; in my case, it is May. Alternatively, you can choose your favorite investment analyst, identified in the “analystName” field, and use their target price. You can also select target prices based on the “analystCompany” field if you trust a particular company that provided the target price calculation and then calculate the average target price from analysts at that company. For this demonstration, I will choose the first option and select the target prices calculated for the last month. You can see the example below

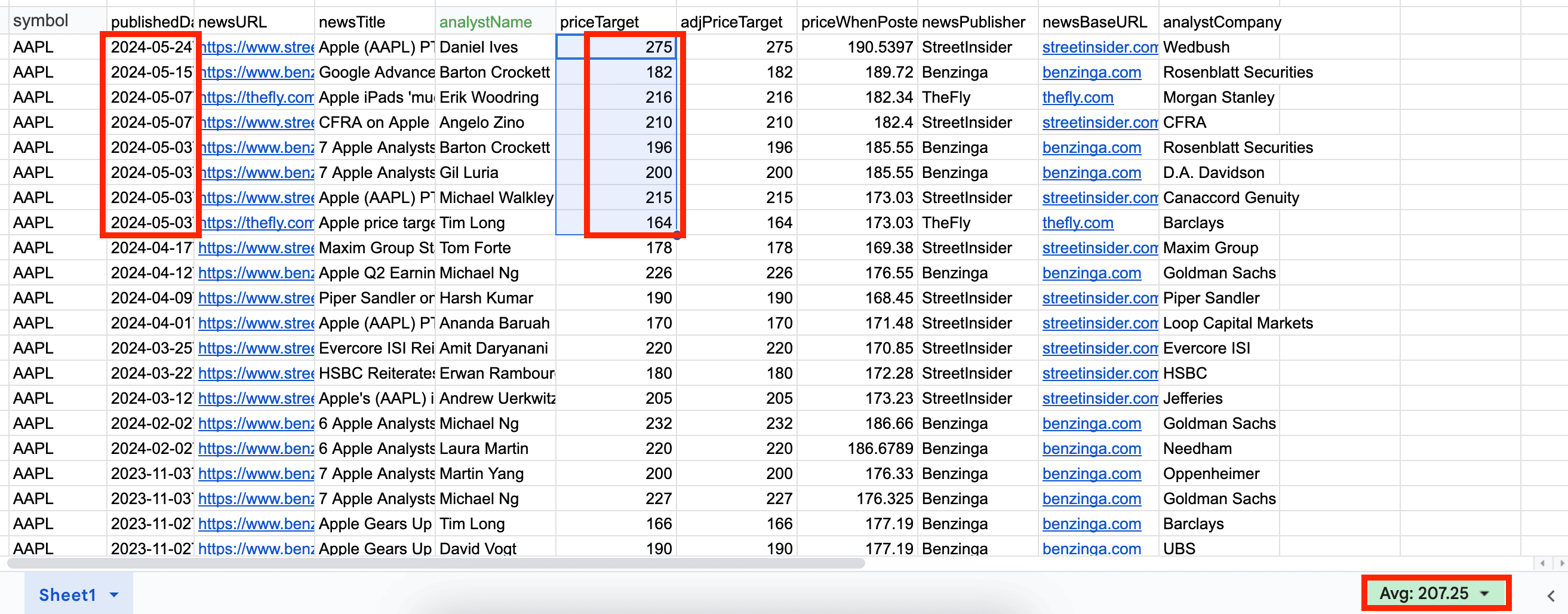

Simply highlight the target prices calculated by different analysts for the month of May, then look at the average number in the bottom right corner. In my case, it is 207.25. I can state that the average target price based on eight investment analysts is $207.25, which appears very realistic. Based on the data I extracted and the average target price from recent analyst calculations, AAPL has a 7.80% growth potential, based on May close.

I have shown you the correct ways to use analysts' target prices if you don't have time to calculate the stock target price manually or if you don't yet have the necessary skills.

I hope my article was useful. Please don't forget to share or repost it if you found it helpful. Remember, analysts' target prices are only estimations based on projected financial data, and their estimations and assumptions can change regularly. Therefore, it is recommended to regularly check company financials, analysts' target prices, and monitor news about your selected company to have up-to-date information and anticipate when analysts might change their stock target prices.

Top 5 Defense Stocks to Watch during a Geopolitical Tension

In times of rising geopolitical tension or outright conflict, defense stocks often outperform the broader market as gove...

Circle-Coinbase Partnership in Focus as USDC Drives Revenue Surge

As Circle Internet (NYSE:CRCL) gains attention following its recent public listing, investors are increasingly scrutiniz...

LVMH Moët Hennessy Louis Vuitton (OTC:LVMUY) Financial Performance Analysis

LVMH Moët Hennessy Louis Vuitton (OTC:LVMUY) is a global leader in luxury goods, offering high-quality products across f...