FMP

The Sector Rotation Playbook: Tracking Fundamental Breakdowns That Spark Leadership Changes

Jan 06, 2026

In the post-pandemic market, sector rotation often reflects deeper fundamental shifts rather than random price swings. By late 2022, for example, higher inflation and interest rates began to erode growth stocks' profitability, while commodity-linked industries held up. Such shifts weren't magic - companies began reporting slower sales growth, tighter profit margins, and cut earnings forecasts, sending a clear signal to analysts.

This article walks analysts and portfolio teams through the data patterns of rotation, showing how company-level cracks (slowing revenues, margin compression, estimate downgrades) cascade into sector-level leadership changes. We focus on the signals and datasets that help you see rotation building over time.

Company-Level Cracks: Early Warning Signals

Before a whole sector rolls over, the trouble usually starts in a few companies. Analysts watch for revenue slowdowns, which often show up as weakening top-line growth in reported results. For example, using FMP's Key Metrics API or Financial Statements API, you can pull a firm's historical revenue and spot decelerating trends.

Similarly, rising costs eat into profits - a squeeze on profit margins (gross or operating margin) often accompanies inflation or supply-chain stress. Monitoring these ratios via FMP's data (e.g. operating margin from income statements) can flag when profitability is waning.

Another red flag is consensus estimate cuts. If analysts repeatedly trim EPS or revenue forecasts for a company, it usually means management is seeing weaker demand. FMP's Financial Estimates API gives real-time access to these forecasts: you can pull the latest analyst projections for revenue and EPS and compare them over time.

For instance, a string of downward revisions across multiple companies in an industry signals a growing slowdown. In short, look for slumping sales, shrinking margins, and falling analyst estimates within a sector. These micro signals often show up well before the price slide - and tracking them quantitatively can provide an early heads-up.

Revenue Growth Decline

Pull each company's quarterly or annual sales from the Key Metrics API or Income Statement endpoints. Watch for sequential drops or a falling growth rate.

Margin Compression

Calculate profit margins (net income ÷ revenue, or operating profit ÷ revenue) over several quarters. Sudden declines often mean costs are rising faster than sales.

Estimate Revisions

Use the Financial Estimates API to track consensus forecasts. A broad net decline in revenue/EPS estimates signals analysts are lowering outlooks.

Other Signs

Rising inventories, higher debt levels, or repeated management warnings (e.g. slowing demand) can also show up in filings or transcripts before stocks drop.

By systematically pulling these metrics via FMP's APIs, analysts can aggregate company signals.

|

For example, if ten companies in Sector A each report a 20% drop in revenue growth, that cumulative trend spells trouble for the whole industry. The key is consistent data access: FMP's endpoints make it easy to automate these checks. |

Sector Signals and Aggregation

Once several companies in a sector flash trouble, their effects aggregate upward. Analysts look at industry-wide charts of revisions, margins and growth. A useful approach is to measure the breadth of the signal - e.g. the percentage of firms issuing negative vs. positive revisions. In practice, one can use FMP's Analyst Estimates API to count upgrades and downgrades across each sector.

|

For example, in one analysis, Technology companies had 61 upward EPS revisions versus 19 downward, for a +69% net rise in estimates, while Consumer firms had far more cuts than raises. |

This breadth tells you where momentum is building: if most companies in a group are trimming guidance, that sector is likely to underperform next.

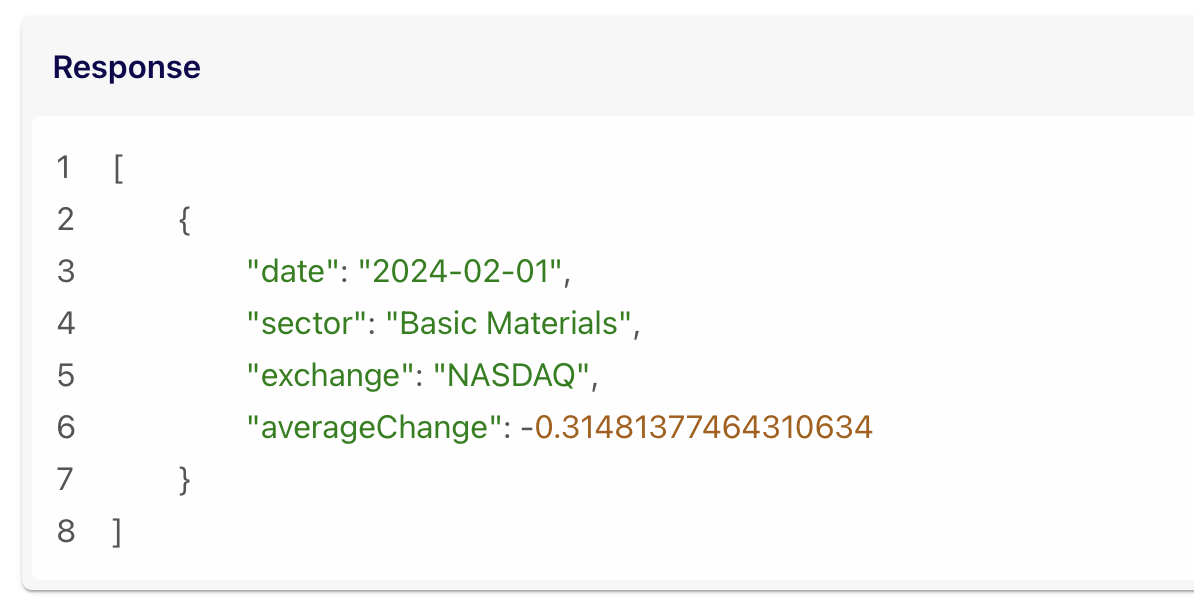

Another sector-level cue is relative performance. The FMP Market Sector Performance Snapshot API gives real-time percentage returns for each sector. By comparing current sector returns (e.g. via daily snapshots) with historical averages, analysts can see which industries are leading or lagging.

Market Sector Performance Snapshot API

A consistent pattern emerges when fundamentals change: sectors burdened by bad data start to underperform the market. For example, if many tech firms miss earnings, the Technology sector index would weaken, and the Snapshot API would immediately show that underperformance. Tracking these sector indexes alongside fundamental signals completes the picture: when sector returns flip and align with fundamental deterioration, a rotation is underway.

Key signals at this stage include:

- Net Revisions Heatmap: A dashboard of revisions by sector (using the Estimates API) highlights which industries have more companies raising forecasts vs. cutting them. A sector with a large net of cuts is on its way down.

- Sector Indices & ETFs: Use the Sector Performance endpoints to see how a sector's index (or leading ETF) is moving. Sustained underperformance often follows the fundamental signals.

- Relative Valuations: Keep an eye on sector valuation multiples (P/E, EV/EBITDA) via FMP's Key Metrics API. Falling multiples may prefigure rotation if earnings growth isn't justifying prices.

Together, these aggregation techniques help map where and when rotation is happening. In the 2022-23 cycle, for instance, sectors tied to rising rates saw widespread estimate cuts early on, and their index returns lagged, while others outperformed - a multi-step signal confirmed by data.

Macro Underpinnings

Sector rotation doesn't happen in a vacuum: macro conditions set the stage. Key economic indicators often explain why certain fundamentals break down. For example, an inflation spike can squeeze consumer demand and pressure retail sales, or raise input costs and compress industrial profits.

FMP's Economic Indicators API provides data on GDP, inflation (CPI, PPI), unemployment, and more. By monitoring these, analysts see the backdrop: a rising CPI may foreshadow margin squeezes in consumer-facing sectors, while higher unemployment could signal falling sales.

Central bank moves are another factor. When interest rates rise, discount rates increase and growth stocks' valuations often fall. You might see this in the financial statements as rising interest expense or in earnings calls as companies delay investment. Wage inflation can show up in hiring plans or in rising SG&A expense.

In short, shifts in macro data (tracked via FMP's Economic Indicators and Calendar APIs) often ripple down to company KPIs.

Crucially, linking macro to sector signals helps confirm rotation. For instance, if the Federal Reserve signals hawkish policy (seen in FOMC minutes or a surprise CPI print), you might expect rate-sensitive sectors to falter first.

Conversely, a positive GDP revision might bolster cyclicals. This is described in “forecast bridges” - pulling economic surprises to sector performance and then to company KPIs. In practice, one could query the Economic Indicators API for the latest print, then immediately use the Historical Sector Performance API to see which industries reacted most. That shows where to focus the bottom-up checks (revenue, margins) next. By connecting the dots (macro → sectors → companies), the rotation becomes an evidence-based flow, not just chart patterns.

Data & Tools for Analysts

Today's analysts have powerful APIs to implement this playbook. FMP offers several endpoints tailored to each step of the rotation analysis:

- FMP Key Metrics API: Revenue, net income, P/E ratios and other KPIs for each company. Use it to pull top-line and profit data for sector peer groups. Declining sector-wide revenue or profit margins (across key names) will show up here.

- FMP Financial Estimates API: Consensus analyst forecasts for revenue, EPS, EBITDA, etc. This is invaluable for gauging forward momentum. A run of downward revisions or falling average estimates signals weakening fundamentals. (Try querying the Forecasts API for several companies in an industry to build an aggregate view.)

- FMP Sector Performance APIs: Real-time and historical sector return data. The Market Sector Performance Snapshot APIdelivers daily percentage changes by sector on each exchange. The Historical Sector Performance API lets you retrieve long-term sector return series. These show you exactly how each sector is behaving today versus its historical norms.

- FMP Economics Indicators API: Real-time macro data (GDP, CPI, unemployment, etc.) Analysts can automatically fetch the latest macro prints to contextualize sector moves. For example, spikes in CPI or an inverted yield curve might precede broad market shifts.

Try it out - for instance, use FMP's Sector Performance Snapshot API to get today's sector returns, and pair that with a query to the Financial Estimates API for your portfolio's companies to see if recent forecasts support the price moves. Embedding these endpoints into internal dashboards makes rotation tracking systematic (e.g. generate a “Net Revisions Heatmap” or watch economic release API feeds).

The FMP blog and documentation provide more examples. For instance, a guide on Forward Guidance shows how waves of EPS revisions and sentiment shifts can predict rotations. And our Forecast Bridges tutorial demonstrates linking macro surprises to sector and company fundamentals. By combining these APIs - macro data, sector returns, company fundamentals and forecasts - analysts can turn chaotic data into a clear rotation signal.

Tracking Fundamental Breakdowns That Spark Leadership Changes

Sector rotation is not just a matter of momentum or fancy charts - it's a story written in the data. When companies face slowing growth and margin pressure, analysts flag those issues early, and the ripple eventually shows up at the industry level. By rigorously tracking top-line and bottom-line metrics, estimate trends, and macro indicators with FMP's data tools, analysts and PMs can see rotation forming, not simply react after the fact.

A sector's leadership change often starts with company-level breakdowns - shrinking sales, rising costs, and collective forecast cuts. These accumulate into sector signals - a surge in downgrades, slipping sector indices - that align with the broader macro environment (inflation, rates, cycles). The FMP APIs like Key Metrics, Financial Estimates, and Sector Performance provide the data layer to observe each step.

FAQs

What is sector rotation?

Sector rotation refers to the shifting of market leadership from one group of industries to another as economic and corporate fundamentals change. For example, rising interest rates or inflation may hurt previously high-flying tech stocks and instead boost commodity or financial sectors. Rotation is driven by company- and economy-level signals (sales, margins, macro data) rather than random ups and downs.

How do revenue declines translate into rotation?

When enough companies in a sector report slowing sales or falling bookings, the sector's overall outlook dims. Investors then rotate capital toward healthier areas. By aggregating each company's revenue data, analysts can see an industry-wide slowdown before it fully shows up in the sector index.

Why do analysts cut earnings estimates, and how does that affect sectors?

Analysts cut estimates when they see fundamentals weakening (e.g. lower guidance from management, higher costs). FMP's Financial Estimates API shows consensus revenue and EPS forecasts. If many companies in a sector slash their outlooks, it indicates growing risk, and the sector often underperforms. In short, downward estimate revisions are an early warning light for sector stress.

How do macro indicators affect sector performance?

Broad economic metrics (GDP growth, inflation, unemployment, etc.) shape business conditions for entire industries. High inflation, for example, can squeeze consumer spending and input costs, pressuring margins in retail and manufacturing. Using FMP's Economics Indicators API, analysts can monitor these trends - rising CPI or a weakening jobs report often presage trouble in sensitive sectors.

Which FMP APIs help analyze sector rotation?

Key ones include: the Financial Estimates API (to fetch analyst forecasts for revenue and EPS); the Key Metrics API (for company revenue, net income, margins); and the Sector Performance Snapshot API (for real-time sector return data). Combining macro data (from the Economics Indicators API) completes the picture. For example, pull today's sector returns with the Snapshot API and compare against the latest earnings estimate revisions to see if fundamentals are aligning with price moves.

Is sector rotation only about technical trading?

No. While momentum can play a role, our analysis shows rotation is deeply rooted in fundamentals and macro trends. We emphasize “looking under the hood” - following revenue, margins and estimate trends - rather than purely extrapolating past price patterns. This people-first approach ensures you understand why allocations shift, not just that they shifted.

WACC vs ROIC: Evaluating Capital Efficiency and Value Creation

Introduction In corporate finance, assessing how effectively a company utilizes its capital is crucial. Two key metri...

BofA Sees AI Capex Boom in 2025, Backs Nvidia and Broadcom

Bank of America analysts reiterated a bullish outlook on data center and artificial intelligence capital expenditures fo...

Pinduoduo Inc. (PDD) Q1 2025 Earnings Report Analysis

Pinduoduo Inc., listed on the NASDAQ as PDD, is a prominent e-commerce platform in China, also operating internationally...